Kanen Wealth Management LLC delivers letter to Board of Lazydays Holdings (LAZY)

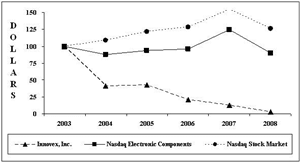

Innovex, Inc. historical performance (Source: Innovex, Inc. 10-k filings)

Innovex, Inc. historical performance (Source: Innovex, Inc. 10-k filings)

TAMPA, Fla., Nov. 30, 2021 (GLOBE NEWSWIRE) -- Dear LAZY Board of Directors,

We are calling on LAZY’s board of directors (the “Board”) to continually evaluate the best candidate Lazydays Holdings, Inc. (“LAZY” or the “Company”) can obtain to run the Company as CEO. As you all know, current CEO Bill Murnane has been chair of LAZY since 2009 – which coincided with Murnane’s predecessor firm Wayzata Investment Partners LLC gaining a substantial stake. Over the last dozen years Murnane has stabilized the business.

We believe LAZY must initiate a search for an auto industry executive with a track record of significant growth and outperformance.

Over the last 12 years in which Murnane has presided over LAZY, the Company has added roughly a dozen new dealerships. LAZY has significantly lagged its two closest peers – Camping World Holdings, Inc. (“Camping World”) and RV Retailer LLC (“RV Retailer”).

RV Retailer was formed in July of 2018 by owner-operator Jon Ferrando, and starting from zero, RV Retailer has added over 80 dealerships in less than 3.5 years. This is many multiples of the growth LAZY has experience over the last 12 years while Murnane has presided over LAZY.

Camping World has added ~120+ dealerships over the last 12 years. Additionally, Camping World has grown its Good Sam membership club to 2.2M users – which built a competitive advantage in the RV space. Camping World has built a peer-to-peer rental platform, a soon to be rolled out full service online buying operation (similar to Carvana), a soon to launch RVs.com which will be a platform to transact peer-to-peer on used RVs, Electric World to be a big player in electrification, a 25M customer database, amongst other growth initiatives.

While LAZY has been “stabilizing,” its two closest peers have operators with great track records of growth. Our CEO’s track record, pre “stabilizing” LAZY, consists of an eight-year tenure as CEO and Director of Innovex, Inc. – a public company which lost ~90% of its value over Murnane’s tenure.

Our CEO is a poor allocator of capital. In our opinion he is a “NON-WINNER.” Murnane has rejected each of our multiple requests to shrink the fully diluted share count when we had a long window of trading between $10-$14/share, or sub 1.5x forward EV/EBITDA on a fully diluted basis. When we first made our pleas, the Company’s warrants were ~$1.30.

Our CEO then turned around and tried to sell stock at ~$15, or ~1.5x forward EV/EBITDA on a fully diluted basis.

These were two extremely poor capital allocation decisions.

Today, LAZY trades at ~2x pro forma EV/EBITDA on a fully diluted basis, and LAZY is doing almost nothing to mitigate dilution and shrink the share count at large discounts to intrinsic value.

In recent months, Murnane has sold nearly $8.5M worth of LAZY shares. Murnane has stated by his actions that he does not believe in LAZY and is significantly reducing his alignment with shareholders. LAZY must search for a CEO who believes in the value of our business. LAZY desperately needs a CEO who can grow the business on par or better than peers and get M&A done. Additionally, LAZY needs a CEO that believes in appropriately allocating our large pro forma cash position.

We believe other shareholders have similar frustrations. We will continue to challenge the board to correct LAZY’s significant underperformance versus peers, our CEO’s underperformance in capital allocation, and our CEO’s demonstration that he doesn’t believe in LAZY.

We are calling on the Board to fulfill its fiduciary duty to shareholders by: 1) immediately conducting a CEO search 2) doing a large buyback/ tender for Warrants and Common Stock for $100 million (70% of 2021 adj EBITDA)

The status quo is no longer acceptable. LAZY BOARD DO YOUR JOB!!!

Sincerely,

Dave Kanen

Kanen Wealth Management, LLC.

David Kanen

dkanen@kanenadvisory.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0f318825-f64d-40c6-b79d-ecfd30008369

Yahoo Finance

Yahoo Finance