Kadant Inc (KAI) Q1 2024 Earnings: Mixed Results Amidst Economic Slowdown

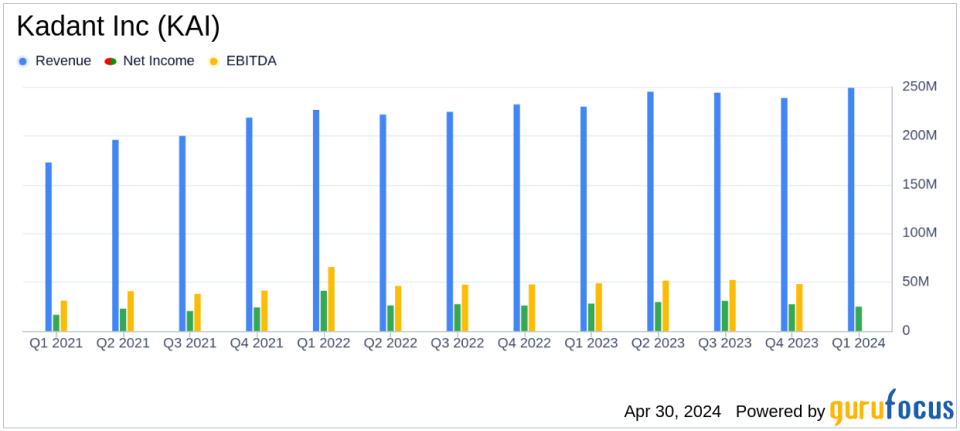

Revenue: Reached $249 million, up 8% year-over-year, surpassing estimates of $246.12 million.

Net Income: Totaled $25 million, down 12% from the previous year, exceeding estimates of $22.20 million.

Earnings Per Share (EPS): Reported GAAP EPS of $2.10, a decrease of 13% year-over-year, surpassing the estimated $1.88.

Gross Margin: Achieved 44.6%, slightly higher than the previous year's 44.4%.

Operating Cash Flow: Declined 38% to $23 million from the prior year.

Bookings: Fell 10% to $248 million from a record $275 million in the previous year.

Adjusted EBITDA: Increased 8% to $52 million, representing 21.0% of revenue.

On April 30, 2024, Kadant Inc (NYSE:KAI) disclosed its financial outcomes for the first quarter ended March 30, 2024, through its 8-K filing. The company reported a revenue increase of 8% to a record $249 million, closely aligning with analyst expectations of $246.12 million. However, net income and GAAP EPS saw declines of 12% and 13% respectively, with net income at $25 million versus the anticipated $22.20 million.

Company Overview

Kadant Inc. is a prominent supplier in the industrial processing and material handling sectors, providing critical equipment for papermaking, recycling, and lumber manufacturing. The company operates through three main segments: Flow Control, Industrial Processing, and Material Handling, serving a diverse global clientele from the U.S. to Asia.

Financial Performance Insights

The first quarter saw Kadant achieve a gross margin of 44.6%, slightly adjusted to 45.5% when excluding acquisition-related costs. Despite the robust revenue growth, the company experienced a significant 38% reduction in operating cash flow, which stood at $23 million. The adjusted EBITDA increased by 8% to $52 million, indicating efficient operational management amidst economic pressures.

Challenges and Market Dynamics

President and CEO Jeffrey L. Powell highlighted the impact of a global manufacturing slowdown, particularly in Europe and Asia, which stymied capital equipment revenue. Nonetheless, a 13% increase in aftermarket parts revenue, which now comprises 69% of total revenue, helped offset these challenges. Bookings decreased by 10% to $248 million, reflecting cautious customer spending in uncertain times.

Outlook and Forward Guidance

Looking ahead, Kadant anticipates a strengthening in industrial demand across various regions. The company maintains its full-year revenue guidance between $1.040 billion and $1.065 billion and adjusted EPS guidance of $9.75 to $10.05, factoring out acquisition-related costs.

Strategic Acquisitions and Financial Health

Kadants recent acquisitions have integrated well, contributing to the record revenue figures. However, the financial health of the company has been pressured by decreased free cash flow, which saw a 49% reduction to $16.6 million. This decline underscores the need for careful financial management in the upcoming quarters.

Investor and Analyst Perspectives

While Kadant has managed to meet revenue expectations and slightly exceed net income forecasts, the declines in net income and EPS could concern investors. The companys ability to navigate economic headwinds while continuing to integrate acquisitions successfully will be critical for future performance.

Kadant Inc remains a key player in its industry, with a strategic focus on aftermarket services and geographical diversification poised to drive long-term growth. Investors and stakeholders will be watching closely to see how the company adjusts to ongoing global economic fluctuations.

For detailed financial figures and future updates, visit Kadants investor relations page or consult the full earnings report filed with the SEC.

Explore the complete 8-K earnings release (here) from Kadant Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance