Do K92 Mining's (TSE:KNT) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like K92 Mining (TSE:KNT). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for K92 Mining

K92 Mining's Improving Profits

In the last three years K92 Mining's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. K92 Mining boosted its trailing twelve month EPS from US$0.22 to US$0.25, in the last year. I doubt many would complain about that 12% gain.

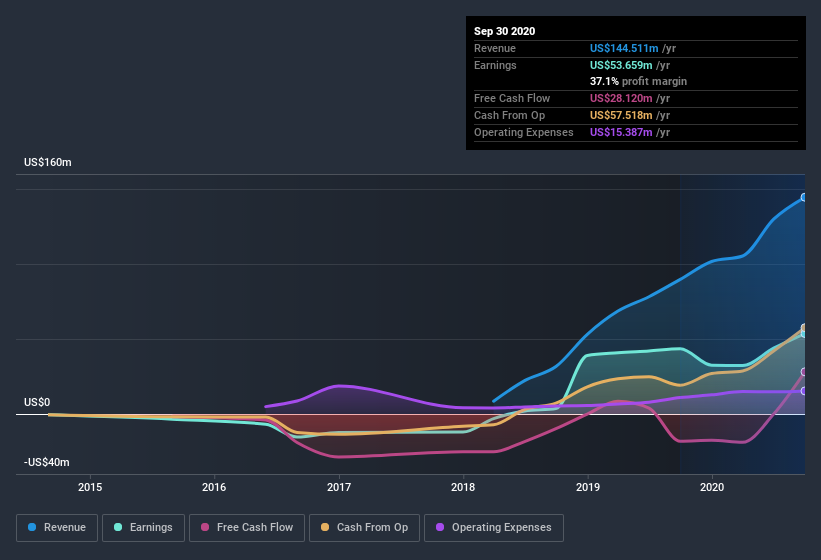

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. K92 Mining shareholders can take confidence from the fact that EBIT margins are up from 37% to 45%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future K92 Mining EPS 100% free.

Are K92 Mining Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that K92 Mining insiders have a significant amount of capital invested in the stock. To be specific, they have US$36m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$1.0b and US$3.2b, like K92 Mining, the median CEO pay is around US$2.0m.

The CEO of K92 Mining only received US$607k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does K92 Mining Deserve A Spot On Your Watchlist?

As I already mentioned, K92 Mining is a growing business, which is what I like to see. The fact that EPS is growing is a genuine positive for K92 Mining, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with K92 Mining (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance