JUSUNG ENGINEERINGLtd And Two Additional KRX Stocks Estimated To Be Trading Below Fair Value

In the last week, South Korea's stock market has remained steady, while showing a modest increase of 6.0% over the past year with earnings expected to grow by 30% annually. In this climate, undervalued stocks like JUSUNG ENGINEERING Ltd may present a compelling opportunity for investors looking to capitalize on potential discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Caregen (KOSDAQ:A214370) | ₩21850.00 | ₩44549.16 | 51% |

Global Tax Free (KOSDAQ:A204620) | ₩3570.00 | ₩6214.60 | 42.6% |

Anapass (KOSDAQ:A123860) | ₩26050.00 | ₩48500.36 | 46.3% |

Genomictree (KOSDAQ:A228760) | ₩21700.00 | ₩39817.72 | 45.5% |

KidariStudio (KOSE:A020120) | ₩4195.00 | ₩7436.92 | 43.6% |

NEXTIN (KOSDAQ:A348210) | ₩64400.00 | ₩109058.40 | 40.9% |

Revu (KOSDAQ:A443250) | ₩10900.00 | ₩20990.57 | 48.1% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

SK Biopharmaceuticals (KOSE:A326030) | ₩77100.00 | ₩149728.31 | 48.5% |

Ray (KOSDAQ:A228670) | ₩13150.00 | ₩20942.86 | 37.2% |

Let's dive into some prime choices out of from the screener

JUSUNG ENGINEERINGLtd

Overview: JUSUNG ENGINEERING Ltd, a South Korean company, engages in the manufacture and sale of semiconductor, display, solar, and lighting equipment globally with a market cap of approximately ₩1.77 trillion.

Operations: The company generates ₩272.61 billion from its semiconductor equipment and services segment.

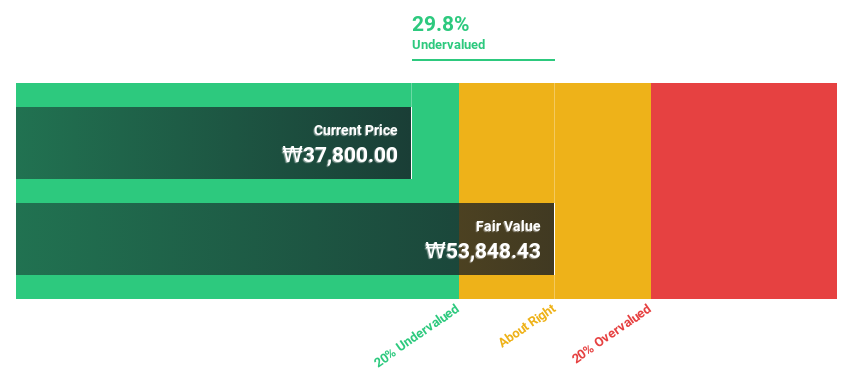

Estimated Discount To Fair Value: 31%

JUSUNG ENGINEERING Ltd., currently trading at ₩37,800, is valued below its estimated fair value of ₩53.85 billion, indicating a significant undervaluation based on discounted cash flow analysis. Despite a decrease in profit margins from 23% to 14.6% over the past year, the company is poised for robust growth with earnings expected to increase by 37.7% annually and revenue projected to grow at 24.1% per year—both rates surpassing market averages significantly. However, it's important to note that large one-off items have affected recent financial results, potentially skewing earnings quality.

Global Standard Technology

Overview: Global Standard Technology, Limited operates in the environmental and energy sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩350.08 billion.

Operations: The company's revenue from semiconductor manufacture equipment totals approximately ₩286.34 billion.

Estimated Discount To Fair Value: 40.2%

Global Standard Technology, trading at ₩20,000, is positioned below its fair value of ₩32.28 billion—a substantial undervaluation. The company's revenue and earnings are expected to grow by 17.5% and 29.7% annually, respectively, outpacing the South Korean market forecasts. Despite this promising growth trajectory and competitive pricing relative to peers, the firm's share price has shown high volatility recently. Additionally, a recent 2:1 stock split aims to enhance stock liquidity but follows a period of unstable dividends and slight declines in sales figures for Q1 2024.

ADTechnologyLtd

Overview: ADTechnology Co., Ltd., based in South Korea, specializes in the design and development of semiconductor devices, with a market capitalization of approximately ₩351.85 billion.

Operations: The company generates its revenue primarily from the design and development of semiconductor devices.

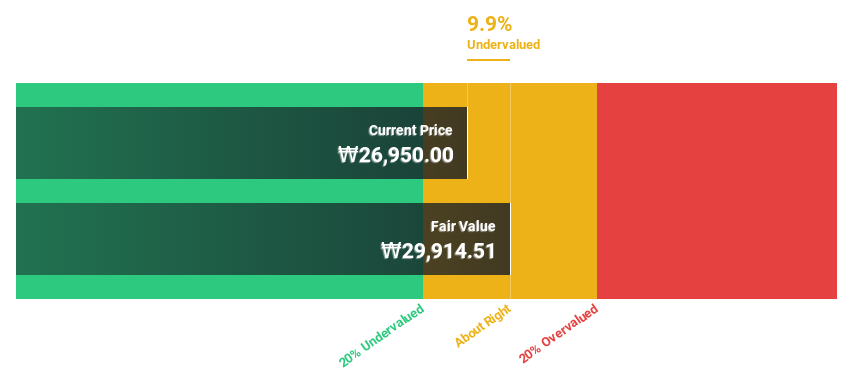

Estimated Discount To Fair Value: 9.9%

ADTechnologyLtd, priced at ₩25700, trades 13.8% below its calculated fair value of ₩29809.53, reflecting a moderate undervaluation. The company's revenue growth is impressive at 37.4% annually, significantly outpacing the South Korean market's average of 10.7%. Expected to turn profitable within three years, ADTechnologyLtd shows promising financial trends with earnings projected to surge by a very large margin annually. However, there is insufficient data to evaluate its future return on equity against benchmarks.

Make It Happen

Get an in-depth perspective on all 37 Undervalued KRX Stocks Based On Cash Flows by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A036930 KOSDAQ:A083450 and KOSDAQ:A200710.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance