Junk Bonds Are All the Rage as Emerging-Market Growth Lures Investors

(Bloomberg) -- A rally in high-yield debt issued by emerging-market countries is back on as investors grow more confident about their economic outlook, backed by some market-friendly policy corrections.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

S&P 500 Tops 5,600 Mark in Longest Rally This Year: Markets Wrap

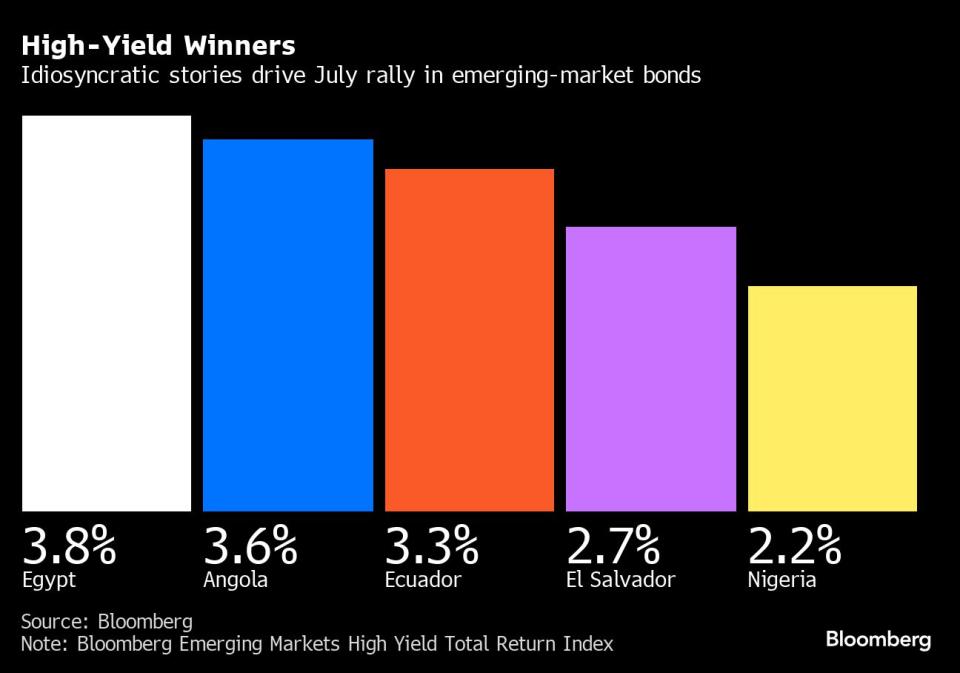

A Bloomberg index of junk-rated bonds from developing nations posted the biggest five-day gain in two months through Monday’s close, led by Egypt, Angola and Ecuador. That sent the $752 billion gauge to a record high in data going back to 1993. The gains come after several weeks of range-bound moves as money managers worried about the potential return of political turmoil to emerging markets.

Those concerns, paired with diminishing returns from International Monetary Fund bailouts and debt-restructuring deals, had led high-yield bonds from emerging markets to underperform investment-grade securities since early April through the start of this month. Now the hunt for yield is pushing investors back to a handful of countries where turnaround stories are taking hold and concerns about economic crisis have abated.

“There is no systemic sovereign default cycle in EM, and even the EM corp default rate YTD is well below trend,” said Uday Patnaik, head of emerging-market fixed income at Legal & General Investment Management Ltd. “EM relative to developed markets have been doing well in terms of growth, particularly the growth differential, FX reserves are at highs and significantly cover maturities and amortisations due this year.”

The latest gains take the Bloomberg high-yield index’s advance this year to 6.8%, far outperforming the 0.7% increase in its counterpart for investment-grade securities. They also outshine local-currency sovereign bonds, which are sitting on losses this year.

Most of the gains in the junk-rated measure have come from sovereign bonds, which account for 78.5% of the index by weight. Corporates take up the balance 21.5%.

The best performers since the start of the month all have improving economic stories to tell.

“The rally in the defaulted bonds — Ghana, Sri Lanka and Zambia — has run its course and the trajectory for the new bonds is uncertain,” said Mark Bohlund, a senior credit research analyst at REDD Intelligence. “So the relative attraction of high-yielding performing assets has risen.”

Egypt has become a darling of investors ever since it bagged more than $57 billion in rescue funds from partners including the UAE and IMF. That, combined with a currency devaluation and interest-rate hike, fueled a rush into the carry-trade potential in Egyptian local assets. The investment got an additional boost from a government reboot that saw reform-oriented financial experts appointed to key ministerial positions and a new economic plan that aims to achieve 5% gross domestic product growth.

Angola, meanwhile, which posted speedier economic growth at 4.6% in the first quarter, is witnessing a surge in oil imports on the back of a rally in crude prices. Spain boosted its imports from Angola by 34% in May compared with the same month last year. The African nation is set to export the most oil in almost four years in August, after it left the Organization of the Petroleum Export Countries.

Ecuador is also recapturing its status as a star performer in the dollar-bond market this year. President Daniel Noboa enjoys a strong approval rating even as he pursues policies that have delighted investors. He’s carrying out wide-ranging fiscal reforms, working on both revenue and spending. And the yield pickup exceeding 1,000 basis points over Treasuries is proving to be too attractive to ignore.

All that means outperformance for the high yielders over US government debt. The extra yield investors demand to own sovereign dollar debt has narrowed so far this month by 46 basis points for Egypt, 40 basis points for Angola and 56 basis points for Ecuador, according to JPMorgan Chase & Co. data.

“In a situation whereby the US will likely cut rates this year, and a rate cutting cycle will start, though perhaps shallower than usual, this will further support investors looking to lock in high yields,” said Legal & General’s Patnaik, who said he’s recently invested in Sri Lanka, Ukraine and Argentina. “Unless you believe that rates will rally meaningfully from here, I think EM investors will stick to preferring EM HY vs EM IG.”

(Adds risk-spread details in the new penultimate paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance