June Undervalued Stock Picks

Undervalued companies, such as Big 8 Split and ICC Labs, trade at a price less than their true values. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. If you’re looking for capital gains in your next investment, I suggest you take a look at my list of potentially undervalued stocks.

Big 8 Split Inc. (TSX:BIG.D)

Big 8 Split Inc. operates as a mutual fund company in Canada. Big 8 Split was formed in 2003 and with the market cap of CAD CA$14.95M, it falls under the small-cap group.

BIG.D’s stock is now trading at -31% beneath its actual level of $24.72, at a price of CA$17.00, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. In addition to this, BIG.D’s PE ratio is trading at around 8.34x relative to its Capital Markets peer level of, 12.94x indicating that relative to its peers, we can purchase BIG.D’s shares for cheaper. BIG.D is also strong in terms of its financial health, with current assets covering liabilities in the near term and over the long run. The stock’s debt-to-equity ratio of 52.80% has been dropping for the last couple of years signalling its capacity to pay down its debt. Continue research on Big 8 Split here.

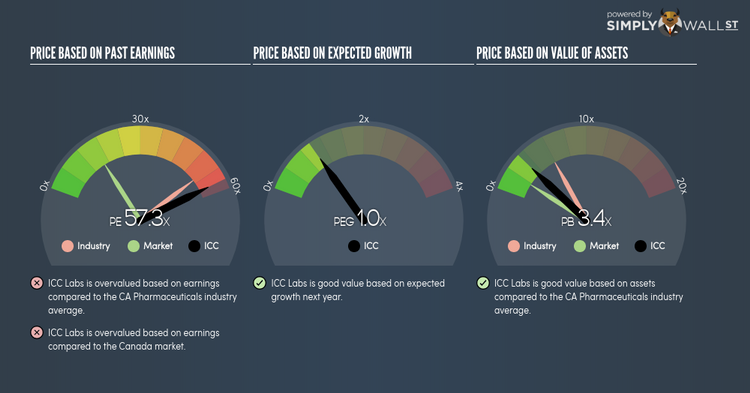

ICC Labs Inc. (TSXV:ICC)

ICC Labs Inc., through its subsidiaries, produces and sells cannabis in Uruguay. The company currently employs 18 people and has a market cap of CAD CA$176.70M, putting it in the small-cap group.

ICC’s shares are currently trading at -51% below its actual worth of $2.63, at a price tag of CA$1.28, based on my discounted cash flow model. This mismatch indicates a chance to invest in ICC at a discounted price.

ICC is also a financially healthy company, as short-term assets amply cover upcoming and long-term liabilities. ICC also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Dig deeper into ICC Labs here.

Evergreen Gaming Corporation (TSXV:TNA)

Evergreen Gaming Corporation engages in the gaming operations in the United States. Evergreen Gaming is currently run by Dawn Mangano. It currently has a market cap of CAD CA$28.48M placing it in the small-cap stocks category

TNA’s shares are currently floating at around -54% lower than its true level of $0.48, at a price of CA$0.22, based on its expected future cash flows. The difference between value and price signals a potential opportunity to buy TNA shares at a discount. Also, TNA’s PE ratio stands at 5.05x relative to its Hospitality peer level of, 18.04x indicating that relative to its comparable company group, TNA can be bought at a cheaper price right now. TNA is also in good financial health, as current assets can cover liabilities in the near term and over the long run. It’s debt-to-equity ratio of 34.82% has been declining for the last couple of years demonstrating its capacity to pay down its debt. More on Evergreen Gaming here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance