June Best Growth Stocks

Stocks that are expected to significantly grow their profitability in the future can add meaningful upside to your portfolio. Teranga Gold and Savaria are examples of many high-growth stocks that the market believe will be upcoming outperformers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

Teranga Gold Corporation (TSX:TGZ)

Teranga Gold Corporation engages in the exploration, development, production, and sale of gold in West Africa. Started in 2010, and now run by Richard Young, the company currently employs 1,400 people and with the market cap of CAD CA$563.56M, it falls under the small-cap stocks category.

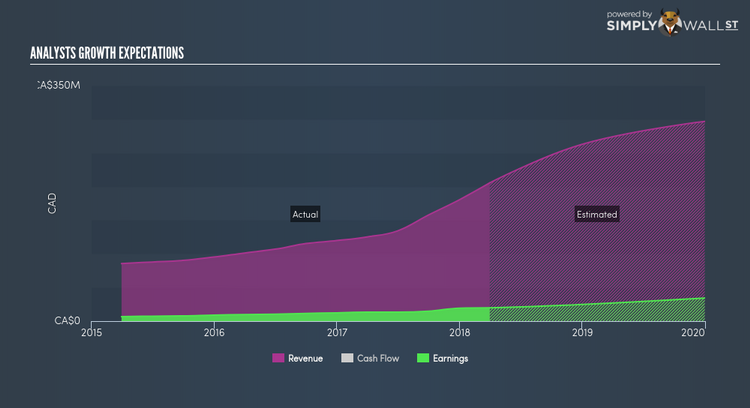

TGZ is expected to deliver a buoyant earnings growth over the next couple of years of 45.59%, driven by a positive double-digit cash flow from operations growth of 34.58% and cost-cutting initiatives. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with operating cash flow expansion. TGZ’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Take a look at its other fundamentals here.

Savaria Corporation (TSX:SIS)

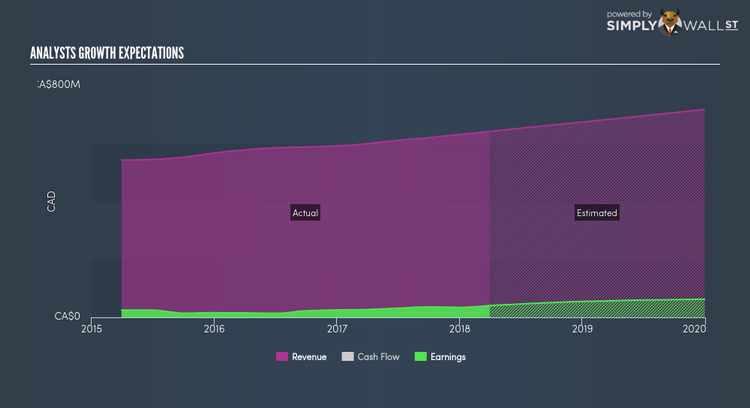

Savaria Corporation designs, engineers, and manufactures products for personal mobility in Canada, the United States, and internationally. Started in 1979, and headed by CEO Marcel Bourassa, the company size now stands at 800 people and with the stock’s market cap sitting at CAD CA$760.47M, it comes under the small-cap group.

Should you add SIS to your portfolio? Check out its fundamental factors here.

Morneau Shepell Inc. (TSX:MSI)

Morneau Shepell Inc. operates as a human resources consulting and technology company in Canada, the United States, and internationally. Founded in 1962, and headed by CEO Stephen Liptrap, the company provides employment to 4,000 people and with the stock’s market cap sitting at CAD CA$1.46B, it comes under the small-cap group.

Considering MSI as a potential investment? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance