June 2024 Insight On UK Growth Companies With High Insider Ownership

As the FTSE 100 shows signs of recovery, ending a five-week slump with a fourth consecutive day of gains, the United Kingdom's market landscape appears increasingly optimistic. In this context, growth companies with high insider ownership can be particularly compelling, as they often demonstrate alignment between management’s interests and those of shareholders, fostering robust governance and potentially enhancing company performance amidst positive market trends.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Getech Group (AIM:GTC) | 17.3% | 86.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Franchise Brands

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franchise Brands plc operates a franchising business with activities in the UK and globally, maintaining a market capitalization of approximately £291.84 million.

Operations: The company's revenue is divided into two primary segments: Azura, which generates £0.76 million, and Filta International, contributing £28.72 million.

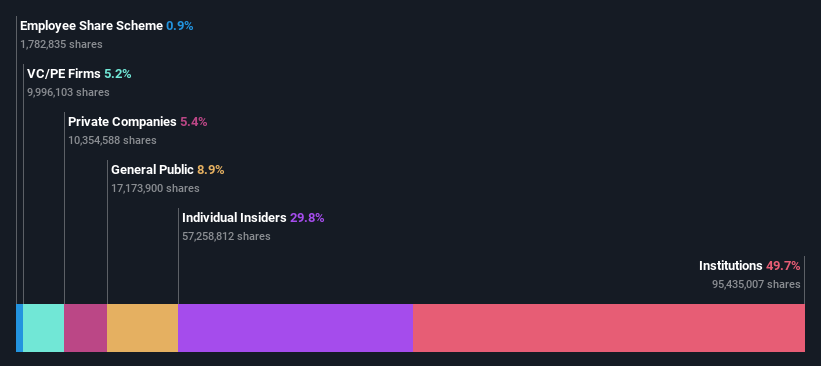

Insider Ownership: 29.8%

Franchise Brands, a UK-based company, is experiencing notable growth with earnings forecasted to increase by 38.68% annually. Despite this, its revenue growth at 8.2% per year outpaces the UK market average but remains below more aggressive growth benchmarks. Recent executive shifts include Andrew Mallows' appointment as interim CFO following Mark Fryer's departure, potentially signaling strategic realignments or stability concerns within their financial leadership structure during a period of expansion and operational scaling under new COO Mark Boxall’s oversight.

Mortgage Advice Bureau (Holdings)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc operates in the United Kingdom, offering mortgage advice services through its subsidiaries and has a market capitalization of approximately £465.97 million.

Operations: The company generates its revenue primarily from the provision of financial services, totaling £236.92 million.

Insider Ownership: 19.9%

Mortgage Advice Bureau (Holdings) demonstrates moderate growth potential with a revenue increase forecast at 13.6% annually, slightly above the UK market average of 3.5%. However, its dividend sustainability is questionable as it is not well-covered by earnings. Recent leadership changes, including Emilie McCarthy's appointment as CFO and Mike Jones as Chair, alongside insider buying activity suggest strategic positioning for future growth despite some concerns over large one-off financial items impacting earnings quality.

Kainos Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc operates as a provider of digital technology services across the United Kingdom, Ireland, North America, Central Europe, and other international markets, with a market capitalization of approximately £1.40 billion.

Operations: The company generates revenue through three primary segments: Digital Services (£213.10 million), Workday Products (£57.25 million), and Workday Services (£112.04 million).

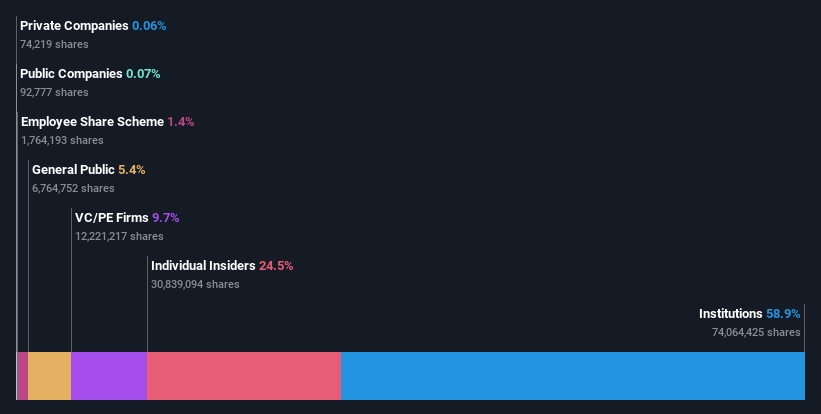

Insider Ownership: 24.5%

Kainos Group plc, a UK-based growth company with high insider ownership, has shown a solid performance with earnings growth of 17% last year. The company's revenue and earnings are expected to grow at 8.6% and 13% per year respectively, outpacing the UK market averages. While its dividend record is unstable, Kainos maintains a strong forecasted return on equity of 30.4%. Recent board changes aim to reinforce governance ahead of their next AGM, ensuring leadership continuity and strategic oversight.

Make It Happen

Access the full spectrum of 67 Fast Growing UK Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:FRANAIM:MAB1LSE:KNOS and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance