June 2024 Insight Into Indian Growth Companies With High Insider Ownership

Despite a flat performance over the past week, India's market has shown robust growth, surging 44% over the past year with earnings expected to grow by 16% annually. In this thriving environment, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Here we highlight a subset of our preferred stocks from the screener.

Prataap Snacks

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Prataap Snacks Limited, with a market capitalization of ₹21.54 billion, operates in the snack food industry both in India and internationally.

Operations: The company generates revenue primarily from its snack food segment, totaling ₹16.18 billion.

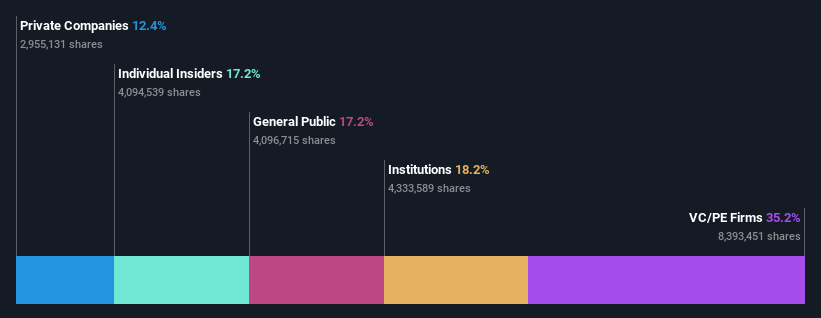

Insider Ownership: 17.2%

Revenue Growth Forecast: 10.1% p.a.

Prataap Snacks, a growth-oriented company with high insider ownership in India, has shown mixed financial performance recently. While its annual net income significantly increased to INR 531.23 million from INR 203.12 million, quarterly figures dipped with net income falling to INR 123.8 million from INR 216.09 million year-over-year. The company's earnings are expected to grow by 22.24% annually, outpacing the broader Indian market's growth rate of 15.9%. Despite this promising outlook, its projected return on equity remains low at 9.8%. Additionally, Prataap Snacks is expanding its production capacity with new units in Gujarat and Jammu & Kashmir, indicating a strategic focus on scaling operations and enhancing product offerings.

Metropolis Healthcare

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Metropolis Healthcare Limited operates as a provider of diagnostic services in India, with a market capitalization of approximately ₹102.83 billion.

Operations: The company generates revenue primarily from pathology services, amounting to ₹12.08 billion.

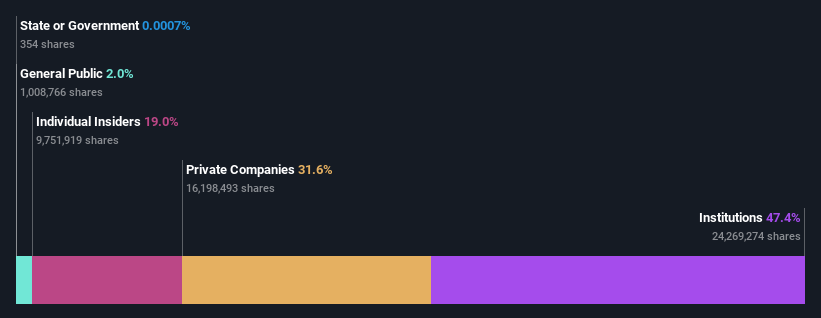

Insider Ownership: 19%

Revenue Growth Forecast: 11% p.a.

Metropolis Healthcare, a prominent Indian diagnostics company, has seen modest revenue growth with annual figures rising to INR 12.17 billion. Despite a slight dip in net income year-over-year, the company is actively pursuing growth through acquisitions aimed at leveraging its strong brand and management capabilities across underserved areas. Insider activities show more buying than selling in recent months, indicating confidence from those within. However, challenges such as regulatory scrutiny over diagnostic test anomalies pose potential risks to its operational reputation and financial health.

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited operates as a franchisee of PepsiCo, producing and distributing carbonated soft drinks and non-carbonated beverages, with a market capitalization of approximately ₹2.01 trillion.

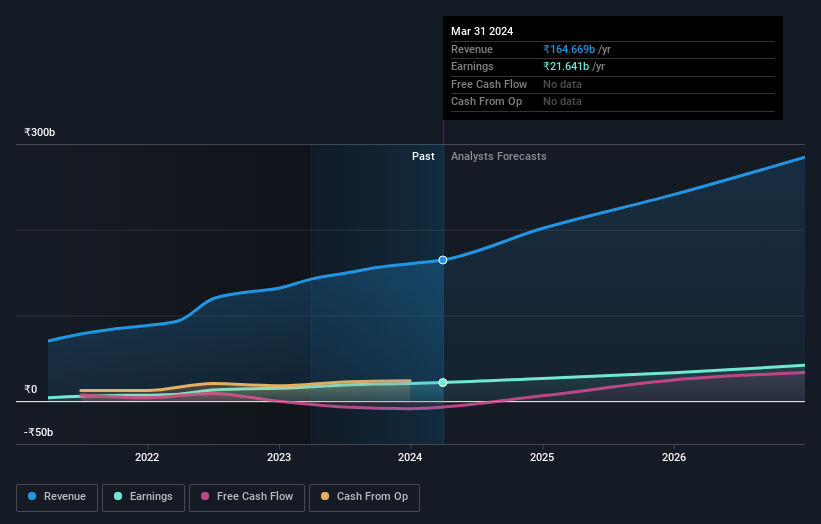

Operations: The company generates revenue primarily from the manufacturing and sale of beverages, totaling ₹164.67 billion.

Insider Ownership: 36.4%

Revenue Growth Forecast: 16.4% p.a.

Varun Beverages, demonstrating robust growth, reported a 29.4% increase in earnings last year with forecasts suggesting a continued upward trajectory at 24.06% annually, outpacing the Indian market's expected growth. Despite high debt levels, its aggressive expansion strategy is evident from recent initiatives like starting production in Uttar Pradesh and establishing a subsidiary in Zimbabwe. The appointment of experienced executives underscores its commitment to strengthening leadership amidst this expansion. However, it's crucial to monitor how these strategic moves impact financial stability and debt management.

Seize The Opportunity

Reveal the 81 hidden gems among our Fast Growing Indian Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:DIAMONDYD NSEI:METROPOLIS and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance