July 2024 Insights Into Three SGX Stocks Estimated Below Value

As Singapore's market navigates through a landscape of strategic acquisitions and technological integrations, exemplified by Chime's recent acquisition of Salt Labs, investors are keenly observing shifts that could highlight undervalued opportunities. In this context, understanding what constitutes a good stock involves looking at fundamentals, market position, and potential for growth amidst current economic activities.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Jardine Matheson Holdings (SGX:J36) | US$35.38 | US$40.44 | 12.5% |

Singapore Technologies Engineering (SGX:S63) | SGD4.33 | SGD7.93 | 45.4% |

LHN (SGX:41O) | SGD0.335 | SGD0.37 | 10.1% |

Hongkong Land Holdings (SGX:H78) | US$3.23 | US$5.64 | 42.7% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.95 | SGD1.62 | 41.3% |

Seatrium (SGX:5E2) | SGD1.38 | SGD2.31 | 40.4% |

Digital Core REIT (SGX:DCRU) | US$0.57 | US$1.11 | 48.5% |

Nanofilm Technologies International (SGX:MZH) | SGD0.745 | SGD1.34 | 44.6% |

Let's review some notable picks from our screened stocks

Jardine Matheson Holdings

Overview: Jardine Matheson Holdings Limited engages in diverse sectors including motor vehicles, property investment, food retailing, and more across China, Southeast Asia, and globally, with a market capitalization of approximately $10.28 billion.

Operations: The company's revenue is primarily generated from motor vehicles and related operations with $20.61 billion, followed by food retailing at $9.17 billion, while smaller contributions come from property investment and development at $1.84 billion, transport services at $2.14 billion, and other sectors including health and beauty, home furnishings, engineering and construction.

Estimated Discount To Fair Value: 12.5%

Jardine Matheson Holdings is trading at US$35.38, below the estimated fair value of US$40.44, indicating it may be undervalued based on discounted cash flows. Despite a dividend yield of 6.36%, its coverage by earnings is weak. Analyst consensus suggests a potential price increase of 27.1%. Earnings are expected to grow by 26.7% annually, outpacing the Singapore market's forecast growth rate. However, substantial insider selling and one-off items have impacted recent financial results negatively.

Nanofilm Technologies International

Overview: Nanofilm Technologies International Limited operates in the field of nanotechnology, offering solutions across Singapore, China, Japan, and Vietnam with a market capitalization of approximately SGD 485.00 million.

Operations: Nanofilm Technologies International's revenue is segmented into Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGD 37.17 million).

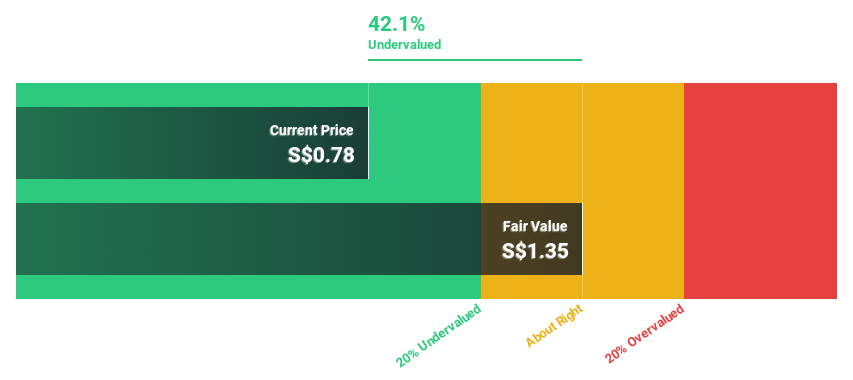

Estimated Discount To Fair Value: 44.6%

Nanofilm Technologies International, priced at SGD0.75, is considered undervalued with its trading value 44.6% below the estimated fair value of SGD1.34 based on discounted cash flow models. While the company’s profit margins have decreased from last year's 18.5% to 1.8%, it forecasts a significant earnings growth of 50.7% per year, outperforming the Singapore market's average of 9%. Recent corporate guidance confirms optimism for FY2024, expecting increased revenues and profits barring unforeseen events.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of SGD 13.50 billion.

Operations: The company's revenue is divided into three main segments: Commercial Aerospace contributing SGD 3.97 billion, Urban Solutions & Satcom at SGD 1.98 billion, and Defence & Public Security generating SGD 4.29 billion.

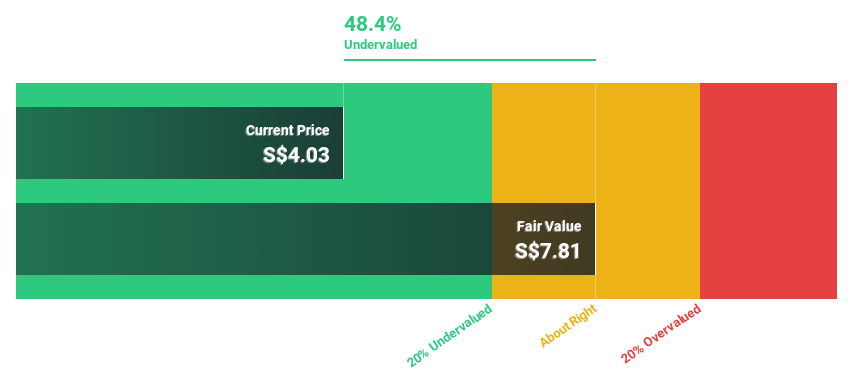

Estimated Discount To Fair Value: 45.4%

Singapore Technologies Engineering, with a current price of SGD4.33, trades significantly below its fair value estimated at SGD7.93, reflecting a potential undervaluation based on cash flows. Despite a high debt level and unstable dividend track record, the company is poised for robust earnings growth at 11.62% annually, outpacing the Singapore market's average. Recent strategic moves include share repurchases and consistent dividend payouts, signaling confidence in financial health and commitment to shareholder value.

Summing It All Up

Unlock our comprehensive list of 8 Undervalued SGX Stocks Based On Cash Flows by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:J36 SGX:MZH and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance