July 2024 Insight Into Undervalued Small Caps With Insider Actions

As global markets exhibit mixed signals with the S&P 500 reaching new heights and small-cap indices like the Russell 2000 showing slight declines, investors are navigating through a landscape shaped by cooling labor markets and fluctuating interest rates. In such an environment, identifying undervalued small-cap stocks becomes particularly compelling, especially those where insider actions suggest unrecognized potential amidst broader market undercurrents.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Hanover Bancorp | 8.2x | 1.9x | 49.58% | ★★★★★☆ |

Tokmanni Group Oyj | 16.8x | 0.5x | 38.77% | ★★★★★☆ |

Calfrac Well Services | 2.3x | 0.2x | 28.96% | ★★★★★☆ |

Guardian Capital Group | 10.6x | 4.1x | 31.22% | ★★★★☆☆ |

M&C Saatchi | NA | 0.6x | 48.52% | ★★★★☆☆ |

Norconsult | 27.9x | 1.0x | 43.92% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.2x | 3.8x | 1.98% | ★★★☆☆☆ |

Russel Metals | 8.6x | 0.5x | -0.65% | ★★★☆☆☆ |

Trifast | NA | 0.4x | -46.02% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

LT Foods

Simply Wall St Value Rating: ★★★★★☆

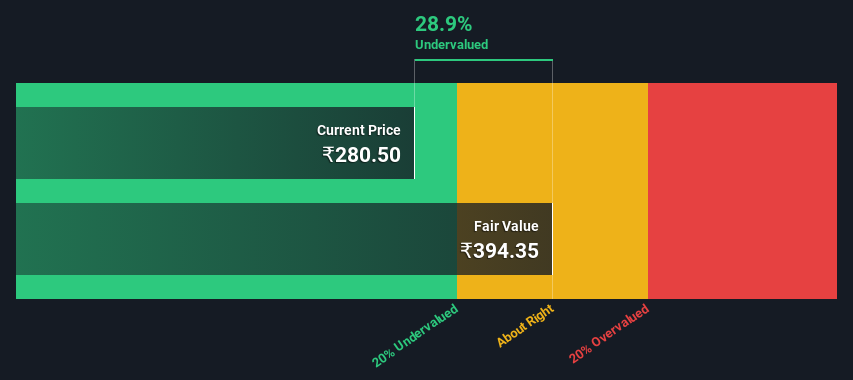

Overview: LT Foods is a company engaged in the manufacturing and storage of rice with a market capitalization of approximately ₹36.14 billion.

Operations: The entity generates a significant portion of its revenue from the manufacture and storage of rice, totaling ₹78.22 billion. It has observed a gross profit margin increase to 32.52% in the most recent period reported, reflecting an upward trend from earlier figures such as 25.07% at the start of the recorded data.

PE: 16.4x

Recently, Radhika Seth demonstrated insider confidence in LT Foods by purchasing 8,795 shares, signaling a positive outlook on the company's prospects. This move aligns with LT Foods' robust financial performance, as evidenced by a substantial increase in annual sales to INR 77.72 billion and net income growth to INR 5.93 billion. Despite facing minor regulatory challenges with fines for legal metrology violations, the firm continues to attract investor interest through consistent shareholder communications and dividend payouts, suggesting resilience and potential for growth amidst market uncertainties.

Unlock comprehensive insights into our analysis of LT Foods stock in this valuation report.

Gain insights into LT Foods' past trends and performance with our Past report.

Marksans Pharma

Simply Wall St Value Rating: ★★★☆☆☆

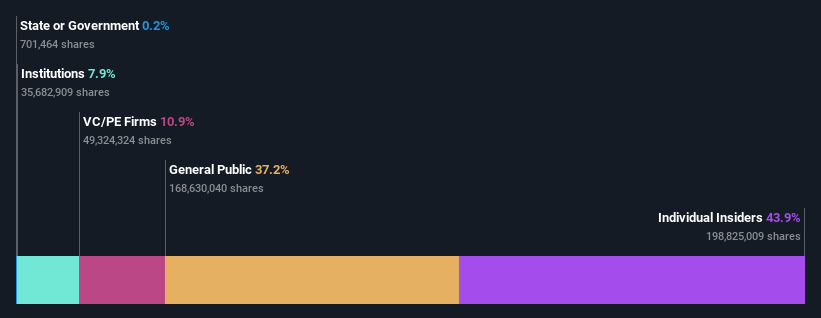

Overview: Marksans Pharma is a pharmaceutical company primarily engaged in the manufacturing and marketing of formulation products, with a market capitalization of approximately ₹21.77 billion.

Operations: Pharmaceuticals generated ₹21.77 billion in revenue, with a gross profit margin of 52.32% as of the latest reporting period, reflecting the cost efficiency in production relative to sales.

PE: 27.8x

Recently, Marksans Pharma showcased a robust financial performance with annual revenues climbing to INR 22.28 billion, up from INR 19.11 billion the previous year, reflecting a solid growth trajectory. Despite a slight dip in Q4 net income, the company's overall annual profits surged to INR 3.14 billion. Insider confidence is evident as they recently purchased shares, signaling belief in the firm’s potential amidst its volatile share price and reliance on external borrowing for funding. With earnings expected to grow by over 21% annually and a fresh dividend proposal on the table, Marksans positions itself as an attractive prospect within the undervalued market segment.

Review our historical performance report to gain insights into Marksans Pharma's's past performance.

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

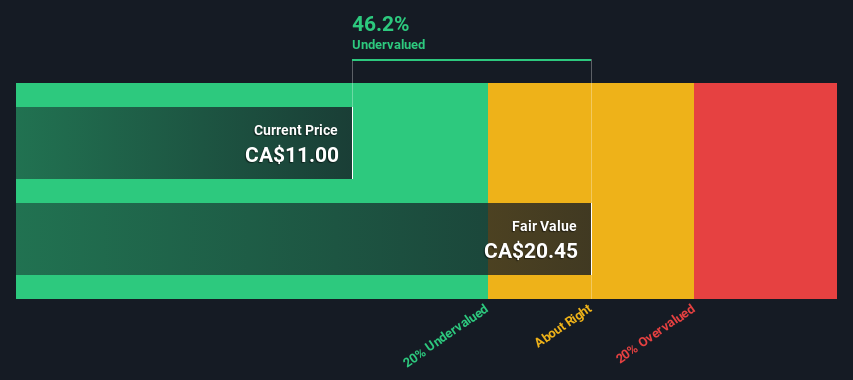

Overview: Dundee Precious Metals is a gold mining company with operations at the Ada Tepe and Chelopech mines, boasting a market capitalization of over CA$1 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, showcasing diverse income sources within the operations. The company's gross profit margin has shown significant fluctuation, ranging from -0.004% to 55%, indicating variability in cost management and revenue generation efficiency over the periods reviewed.

PE: 8.9x

Dundee Precious Metals, reflecting insider confidence with recent strategic purchases, signals a robust outlook. As of July 2024, the firm has maintained strong production forecasts and operational results, processing up to 755.5 Kt of ore in Q2 alone and projecting annual figures significantly higher. The addition of W. John DeCooman Jr., with extensive corporate development experience, aligns well with their growth trajectory in challenging markets. This move coupled with consistent dividend payouts underscores their potential amidst undervalued peers in the mining sector.

Next Steps

Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 224 more companies for you to explore.Click here to unveil our expertly curated list of 227 Undervalued Small Caps With Insider Buying.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:LTFOODS NSEI:MARKSANS and TSX:DPM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance