July 2024 Insight: 3 SEHK Stocks Estimated To Be Trading Below Fair Value

Amidst a backdrop of global economic fluctuations and mixed performances in key markets, the Hong Kong stock market has shown resilience, with the Hang Seng Index posting modest gains. This stability presents an intriguing opportunity for investors to consider stocks that may be trading below their fair value, potentially offering attractive returns in a cautiously optimistic economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Giant Biogene Holding (SEHK:2367) | HK$40.70 | HK$75.83 | 46.3% |

China Cinda Asset Management (SEHK:1359) | HK$0.66 | HK$1.29 | 48.8% |

Super Hi International Holding (SEHK:9658) | HK$13.92 | HK$26.04 | 46.5% |

Shanghai INT Medical Instruments (SEHK:1501) | HK$26.45 | HK$48.23 | 45.2% |

Zhaojin Mining Industry (SEHK:1818) | HK$14.98 | HK$29.86 | 49.8% |

BYD (SEHK:1211) | HK$235.20 | HK$464.83 | 49.4% |

AK Medical Holdings (SEHK:1789) | HK$4.34 | HK$7.95 | 45.4% |

Vobile Group (SEHK:3738) | HK$1.20 | HK$2.31 | 48.1% |

MicroPort Scientific (SEHK:853) | HK$5.16 | HK$9.48 | 45.6% |

Q Technology (Group) (SEHK:1478) | HK$4.05 | HK$7.45 | 45.7% |

Let's take a closer look at a couple of our picks from the screened companies

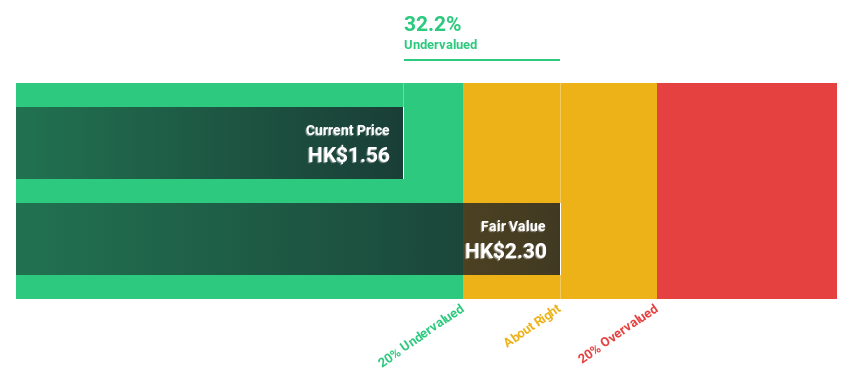

Pacific Textiles Holdings

Overview: Pacific Textiles Holdings Limited is a company that manufactures and trades in textile products, with a market capitalization of approximately HK$2.34 billion.

Operations: The company generates its revenue primarily from the manufacturing and trading of textile products, totaling approximately HK$4.67 billion.

Estimated Discount To Fair Value: 38.3%

Pacific Textiles Holdings is currently trading below its fair value by 38.3% at HK$1.67, against a fair value estimate of HK$2.71, highlighting its potential undervaluation based on cash flows. Despite a significant decrease in net profit and a drop in sales from HK$5.02 billion to HK$4.67 billion year-over-year, the company's earnings are expected to grow by 37.7% annually, outpacing the Hong Kong market average growth of 11.3%. However, profit margins have declined and recent corporate governance updates aim to align with new regulatory standards.

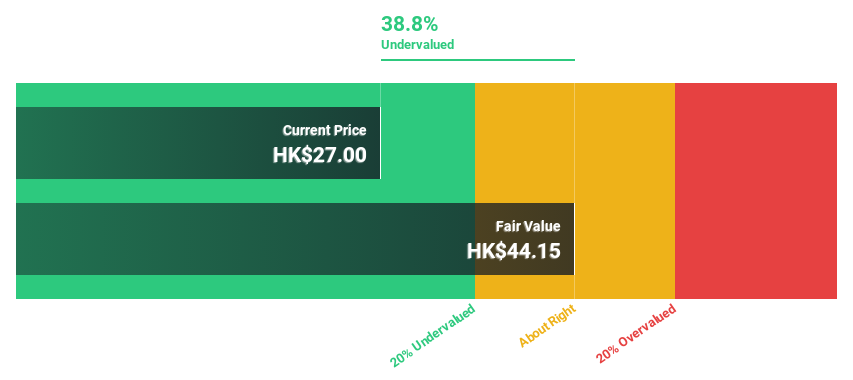

Shanghai INT Medical Instruments

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the healthcare sector, focusing on the development and manufacture of medical instruments, with a market capitalization of approximately HK$4.63 billion.

Operations: Shanghai INT Medical Instruments primarily generates revenue from its cardiovascular interventional business, totaling CN¥641.32 million.

Estimated Discount To Fair Value: 45.2%

Shanghai INT Medical Instruments is significantly undervalued based on DCF, with its current price of HK$26.45 sitting well below the estimated fair value of HK$48.23. The company's revenue and earnings are projected to grow at 26% and 25.4% per year respectively, outstripping the Hong Kong market averages significantly. Despite past shareholder dilution, recent dividend increases reflect a positive cash flow outlook, further underscoring its potential as an undervalued stock in Hong Kong’s market.

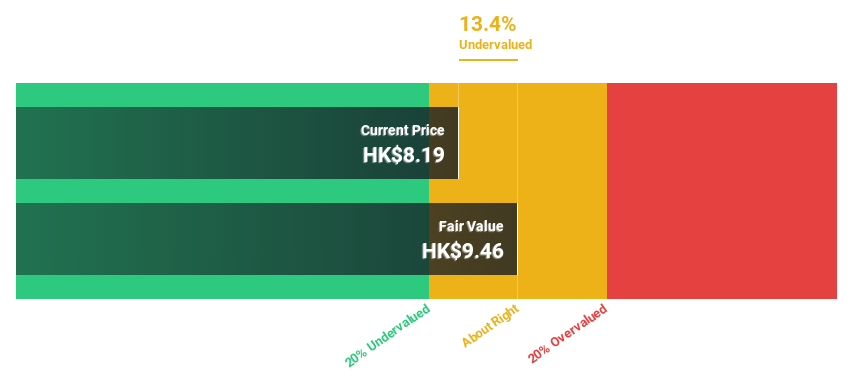

China International Capital

Overview: China International Capital Corporation Limited operates as a financial services provider in Mainland China and globally, with a market capitalization of approximately HK$101.29 billion.

Operations: The company generates its revenues from various financial services both in Mainland China and internationally.

Estimated Discount To Fair Value: 13.4%

China International Capital Corporation Limited, trading at HK$8.19, is positioned below the estimated fair value of HK$9.46, suggesting a modest undervaluation based on discounted cash flow analysis. The company's revenue and earnings growth projections of 8.4% and 20.35% annually are poised to surpass Hong Kong market averages of 7.6% and 11.3%, respectively. However, its forecasted return on equity in three years at 6.9% remains low, indicating potential concerns about profitability efficiency despite positive growth metrics.

Turning Ideas Into Actions

Embark on your investment journey to our 42 Undervalued SEHK Stocks Based On Cash Flows selection here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1382 SEHK:3908 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance