July 2024 ASX Leaders With High Insider Ownership And Strong Growth Prospects

As the Australian market experiences a positive uptick, with the ASX200 poised to climb over one percent this morning following robust gains on Wall Street, investors are keenly observing trends and opportunities. In such an environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the company's operations and future.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 59.4% |

Ora Banda Mining (ASX:OBM) | 10.2% | 94.3% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Chrysos (ASX:C79) | 21.3% | 63.5% |

We're going to check out a few of the best picks from our screener tool.

Emerald Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.53 billion.

Operations: The company generates revenue primarily from mine operations, totaling A$339.32 million.

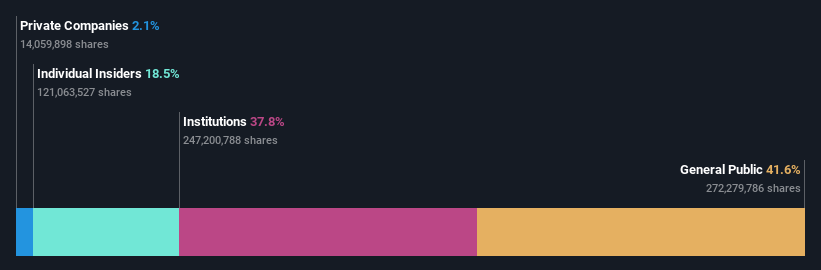

Insider Ownership: 18.5%

Emerald Resources has demonstrated robust growth with a 53.4% increase in earnings over the past year. Despite some shareholder dilution, EMR is poised for substantial future growth, with earnings expected to rise significantly at an annual rate of 23.2% and revenue forecasted to grow at 18.6% per year, both outpacing the Australian market averages of 13% and 5.3%, respectively. Additionally, EMR's Return on Equity is projected to be high at 20.7% in three years' time.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.71 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel services, totaling A$1.28 billion and A$1.06 billion respectively.

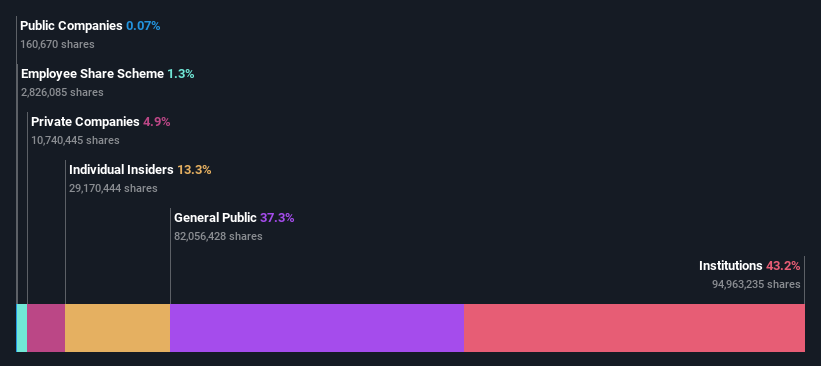

Insider Ownership: 13.3%

Flight Centre Travel Group, while not the top in its class, shows promise with earnings forecasted to grow by 18.84% annually, outpacing the Australian market's 13%. This growth is supported by a solid forecast Return on Equity of 21.8% in three years. Despite slower revenue growth projections at 9.7% yearly, this still exceeds the market average of 5.3%. The stock is currently valued at 31% below its estimated fair value, indicating potential for appreciation.

Mesoblast

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mesoblast Limited, operating in Australia, the United States, Singapore, and Switzerland, focuses on developing regenerative medicine products with a market capitalization of approximately A$1.25 billion.

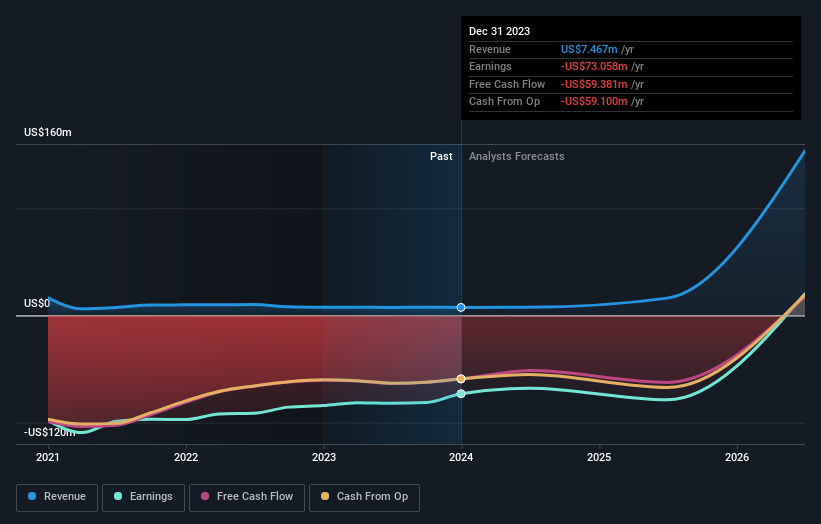

Operations: The company generates revenue primarily from its development of adult stem cell technology platform, totaling $7.47 million.

Insider Ownership: 22.6%

Mesoblast, an Australian biotech firm, shows potential with insider buying trends and is forecasted to become profitable within three years. Despite some shareholder dilution over the past year, earnings are expected to grow by 48.83% annually. Recent developments include the resubmission of its BLA for Ryoncil, targeting a high-mortality pediatric condition, which has received Fast Track and Priority Review designations from the FDA. However, trading at 89.7% below estimated fair value suggests significant undervaluation or investor caution regarding its prospects.

Seize The Opportunity

Navigate through the entire inventory of 91 Fast Growing ASX Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:EMR ASX:FLT and ASX:MSB

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance