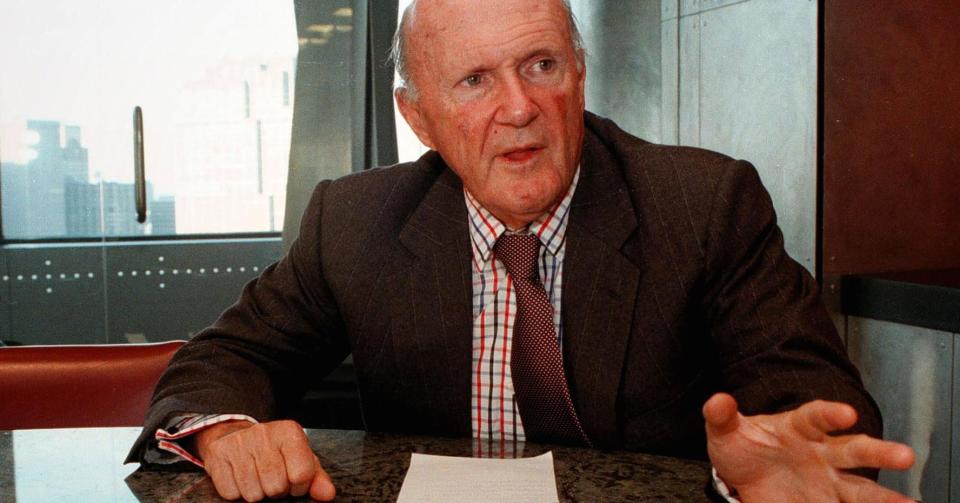

Julian Robertson: 'There’s too much talent in the same game'

Billionaire hedge fund legend Julian Robertson, the founder of Tiger Management, highlighted a number of key challenges for the hedge fund business, including the limited number of attractive investment opportunities and the ever increasing pool of players in the business.

Speaking at Grant’s Interest Rate Observer Fall Conference in New York on Tuesday, Robertson said: “I think almost everything that is particularly attractive is a little bit unusual. I mean, there’s certain stocks that are for some reason selling at three and four-times earnings — Air Canada, for instance. But you can’t just build a portfolio on those. I think if you look for things that are undervalued whether a currency or a stock and you can find out the reason for the undervaluation, I think there you can buy.”

However, Robertson doesn’t recommend just investing long. He recommends hedging in the classical sense: by offsetting much of that risk with short positions.

“In spite of the fact that we have all been beaten around for the last several years, the hedge fund is a great way to run money,” he said. “I think it suffers now because there’s too much talent in the same game. And shorting, which when I got into the business was almost a license to steal, is now a license for bankruptcy.”

He added that he doesn’t think this will always be the case.

Robertson joins a chorus of big-name hedge fund managers, including Steve Cohen of Point72 Asset Management, who’ve said there’s just too many players in the businsess. It’s estimated that there are more than 10,000 hedge funds. Some estimates have put the number at 15,000.

Right now, investment management and hedge funds seem to be an extremely popular occupation, which is concerning.

“I think it’s certainly not a good omen,” Robertson said.

Robertson, who was one of the original fund managers and has seeded many fund managers, thinks the industry will be fine in the long run. He still believes in the model established by Alfred Winslow Jones, who is known as the first hedge fund manager.

“I think it’s still a sound model. Basically it says, in essence…as a money manager you pick the 50 stocks you think are the greatest and apply them against the 50 that are the worst. In the long run you’ll come out fine. If you don’t, there’s probably another business,” he said, “It’s been a long time since I thought I was in the right business.”

Hedge funds lately have been criticized for their lackluster returns and the fees that they charge investors. In the long run, Robertson expects hedge funds to prevail.

“We’ll get through this in one of two ways— probably because something is going to blow up in these markets and hedge funds during that period have always done better than the other investment mediums. I fully expect that to happen this time.”

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Billionaire Rubenstein: These 6 traits will help you succeed on Wall Street

How a $650,100 lunch with Warren Buffett changed one hedge fund manager’s life

Warren Buffett once said these are 2 of the more important decisions you’ll make in life

Buffett: Your business will succeed if you execute this 3-word mission

A hedge fund manager gave some blunt advice to a bunch of 9th grade boys

Yahoo Finance

Yahoo Finance