JPMorgan’s Trading Desk Warns S&P 500 Will Turn Volatile on CPI

(Bloomberg) -- Investors should brace themselves for a bout of stock market volatility this week after a lengthy period of calm, based on a warning from JPMorgan Chase & Co.’s trading desk.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Microsoft Orders China Staff to Use iPhones for Work and Drop Android

S&P 500 Holds Gains as Fed Bets Steady on Powell: Markets Wrap

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

The options market is betting the S&P 500 Index will move by 0.9% in either direction by Thursday, based on the price of at-the-money straddles expiring that day, according to Andrew Tyler, the trading desk’s head of US market intelligence. The latest consumer price index will be reported prior to that session, which could trigger a move with traders betting on easing inflation driving the Federal Reserve to cut interest rates twice in 2024.

“We have had multiple former Fed governors suggest that September is appropriate for a cut,” Tyler and his team wrote in a note to clients on Tuesday. “With this in mind, we remain tactically bullish, but with slightly less conviction.”

Central bankers typical see the core CPI reading, which strips out the volatile food and energy components, as a better underlying indicator of inflation than the headline measure. In May, core CPI climbed 0.16% from a month prior — the softest since August 2021.

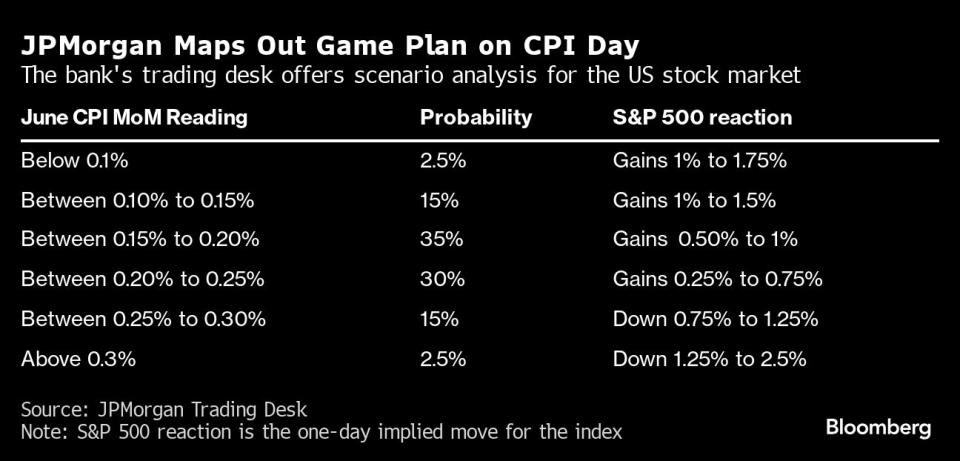

The forecast is for June’s core CPI to rise 0.2% from a month earlier. If it tops 0.3%, that would likely spur a selloff across risk assets, with the S&P 500 falling between 1.25% to 2.5%, according to Tyler. But he sees just a 2.5% chance of that happening.

If core CPI comes in between 0.15% and 0.20% from the prior month — the most likely scenario to JPMorgan’s trading desk — the S&P 500 is expected to rise 0.5% to 1%, Tyler wrote. If it comes in between 0.20% to 0.25%, there may initially be a negative reaction in equities, but falling bond yields will ultimately support stocks, sending the S&P 500 up between 0.25% and 0.75%, according to Tyler.

Anything below 0.1% will be considered extremely positive for equities, likely pulling forward some calls for a July rate cut and sparking a rally of between 1% to 1.75% in the S&P 500, he added.

The potential for a large swing around the CPI report and Fed decision comes as volatility across markets has been historically restrained. The the Cboe Volatility Index, or VIX, is trading around 12, near a 52-week low and far from the 20 level that starts to raise concerns for traders. The market pricing in a roughly 70% probability that Fed will cuts rates in September.

“Another step-down would be a positive signal to the markets and likely make the calls for a September cut become deafening,” Tyler wrote. “One key is whether any of the decline is attributed to shelter prices since this has been a source of the stickiness and any material step-down here is well received and may portend even more disinflation.”

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Family Offices of the Ultra-Rich Shed Privacy With Activist Bets

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance