JOBS DAY IN AMERICA — What you need to know in markets on Friday

It’s jobs day in America.

The employment report from the Bureau of Labor Statistics is due out at 8:30 a.m. ET Friday, capping what’s been a busy week of US economic data.

This will be the first jobs report since the presidential election and the final jobs report delivered before the calendar flips to 2017.

Jobs, Jobs, Jobs

Via Bloomberg, here’s what Wall Street expects in Friday’s jobs report:

Nonfarm payrolls: +180,000 (+161,000 previously)

Unemployment rate: 4.9% (4.9% previously)

Average hourly earnings, month-on-month: +0.2% (+0.4% previously)

Average hourly earnings, year-on-year: +2.8% (+2.8% previously)

Goldman Sachs economists expect the headline payrolls number to come in at 200,000, higher than consensus estimates.

“We have revised up our forecast from 180k previously reflecting stronger data this week,” Goldman economists Avisha Thakkar and Daan Struyven write.

“Labor market indicators were stronger on balance last month, including improvements in reported job availability, the ADP report, and the employment components of service-sector surveys. In addition, we see a likely boost from positive weather effects and possible residual seasonality.”

The headline jobs number is always of interest to markets, but the wage data reported Friday should be more closely-watched by investors.

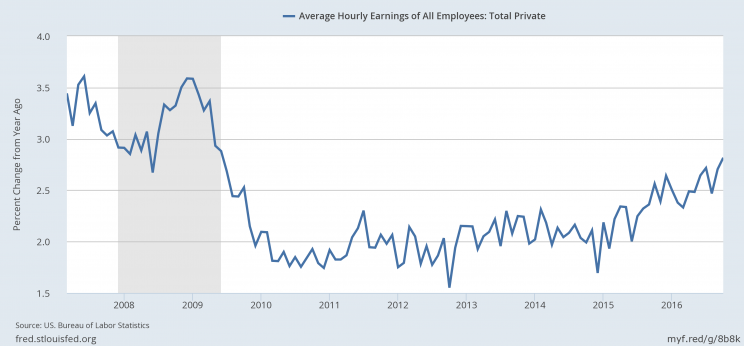

Wage gains — which at 2.8% year-on-year hit a post-crisis high in October — are seen as a sign of future inflation, which could have big implications for the Federal Reserve.

This week, we learned that “core” PCE — a consumer price measure that excludes the more volatile costs of food and gas and is preferred by the Federal Reserve — rose 1.7% over the prior year in November. “Core” CPI, a measure that tracks consumer prices but gives a bit more weight to housing costs, has been rising more than 2% compared to the prior year

And so an increase in wages could be what pushes these numbers back above the Fed’s inflation threshold and push the central bank to act more aggressively on raising interest rates.

Currently, markets expect the Fed to raise rates at its December 13-14 policy meeting, but raise rates just two times in 2017.

“The financial markets have already fully priced in a December Fed rate hike, taking some anticipation away from this week’s employment report release,” write economists at Wells Fargo.

“Interest, however, will remain high for an updated assessment on the state of the US labor market as the year comes to an end. On balance, we expect the recent trends in hiring, unemployment and earnings growth to be maintained in the November report.”

Further Reading

Could the S&P 500 rise 19% next year? (Yahoo Finance)

Starbucks CEO Howard Schultz is stepping down (CNBC)

Understanding Uber’s uncompetitive costs (Naked Capitalism) Related: Uber’s bleak operating economics (Naked Capitalism)

Indiana gives Carrier a $7 million tax break to keep jobs in the state (WSJ)

Bonds had their worst month since at least 1990 in November (Bloomberg)

NFL teams had the NFL’s social media rules (Yahoo Finance)

Beaver invades store (WaPo)

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance