JinkoSolar (JKS) to Report Q1 Earnings: What's in the Cards?

JinkoSolar Holding Co., Ltd. JKS is expected to report first-quarter 2024 results on Apr 29, before the opening bell.

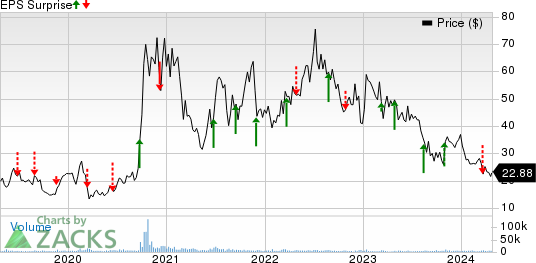

In the last reported quarter, the company delivered a negative earnings surprise of 47.84%. JinkoSolar has a trailing four-quarter average earnings surprise of 89.84%.

Factors to Note

Increased module shipment, especially that of JinkoSolar’s N-Type module, backed by increasing solar demand, is expected to have contributed favorably to the company’s first-quarter revenues. However, the continuing decline in the average selling price of modules in the quarter might have fetched lower revenues from the sale of modules on a year-over-year basis.

JinkoSolar Holding Company Limited Price and EPS Surprise

JinkoSolar Holding Company Limited price-eps-surprise | JinkoSolar Holding Company Limited Quote

Region-wise, JinkoSolar is expected to have sold nearly 50% of its modules to the Chinese market, which offers lower prices. This might have resulted in lower revenues from its Chinese market, thereby negatively impacting its overall top-line performance.

Solid demand from Europe, North America and emerging markets, particularly the Asia-Pacific region, is likely to have contributed favorably to JKS’ first-quarter revenues.

The Zacks Consensus Estimate for JKS’ first-quarter revenues is pegged at $3.27 billion, indicating a decline of 3.9% from the year-ago quarter’s reported figure.

The declining average selling price of solar modules is expected to have hurt the gross margin for the company. This, along with dismal revenue expectations, increased interest expenses as well as increasing staff costs, might have adversely impacted JKS’ overall bottom-line performance.

The Zacks Consensus Estimate for JKS’ first-quarter earnings is pegged at a loss of 44 cents per share, indicating a deterioration from the year-ago quarter’s reported earnings of $1.53.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for JinkoSolar this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Earnings ESP: JKS’ Earnings ESP is 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: JinkoSolar currently carries a Zacks Rank #5 (Strong Sell).

Stocks to Consider

Here are three solar companies that you may want to consider as these have the right combination of elements to post an earnings beat this reporting cycle.

Canadian Solar CSIQ currently has an Earnings ESP of +29.52% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CSIQ’s first-quarter sales is pegged at $1.28 billion, while that for earnings is pegged at a loss of 26 cents per share. CSIQ delivered a four-quarter average earnings surprise of 56.24%.

Sunnova Energy International NOVA currently has an Earnings ESP of +8.38% and a Zacks Rank #3. The Zacks Consensus Estimate for NOVA’s first-quarter sales is pegged at $193 million, indicating an improvement of 19.4% from the prior-year reported figure.

NOVA delivered an earnings surprise of 16.67% in the last reported quarter. The consensus estimate for first-quarter earnings is pegged at a loss of 77 cents per share.

Nextracker NXT currently has an Earnings ESP of +23.75% and a Zacks Rank #1. The Zacks Consensus Estimate for NXT’s first-quarter sales is pegged at $681.8 million, indicating an improvement of 31.5% from the prior-year reported figure.

NXT delivered an average four-quarter earnings surprise of 56.26%. The consensus estimate for first-quarter earnings is pegged at 60 cents per share, implying an improvement of 185.7% from the year-ago quarter’s reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JinkoSolar Holding Company Limited (JKS) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Sunnova Energy International Inc. (NOVA) : Free Stock Analysis Report

Nextracker Inc. (NXT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance