Japan’s Kanda Keeps Investors Guessing Over Yen Intervention

(Bloomberg) -- Japan’s currency chief stuck with his strategy of trying to keep market players in the dark over whether Tokyo stepped in to prop up the yen following sharp moves in the currency Thursday.

Most Read from Bloomberg

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

“Our practice is basically not to say whether we have intervened or not,” said Masato Kanda, vice finance minister for international affairs.

Kanda spoke after an abrupt strengthening of the yen following softer-than-expected US inflation figures. Japanese broadcaster TV Asahi reported that the government and Bank of Japan had intervened in the market, citing an unidentified person.

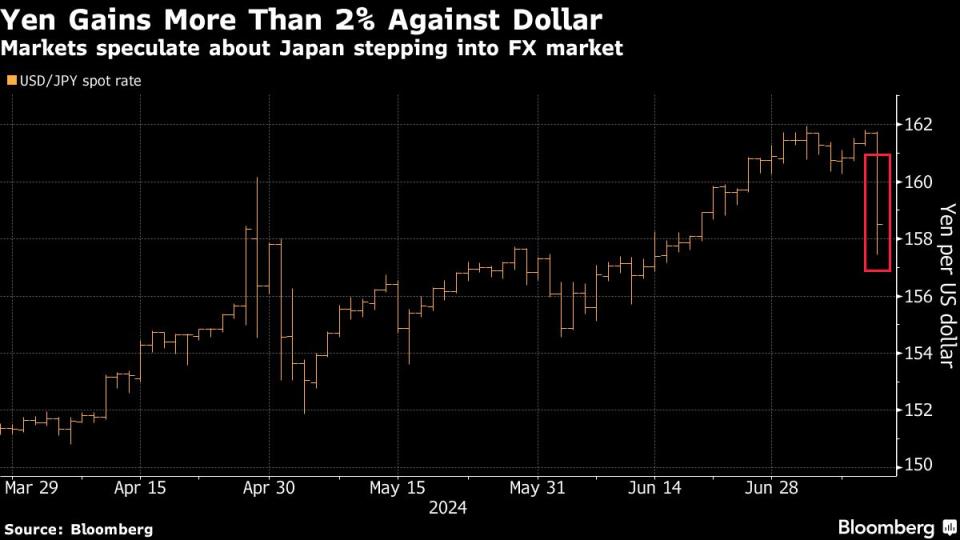

Japan’s currency firmed sharply from around 161.58 against the dollar to 157.44 in little more than half an hour, generating speculation that Tokyo had taken advantage of an initial movement after the data to then step into the market.

While some market watchers had been alert to the possibility of intervention if US prices proved hotter than expected prompting a yen slump, the likelihood of Japan stepping in if the yen started strengthening after weak data had not been on the radar.

“While some believe the move was a reaction to the CPI results, others say that other forces may have been at work,” Kanda said. If Japan has intervened, it will disclose the amount at the end of the month, he added.

Under Kanda, Japan has tried to maximize the impact of its currency policy by leaving doubt in the market over its actions to create a degree of unpredictability that keeps speculators on edge.

Japan spent a record ¥9.8 trillion ($62 billion) around the end of April and the beginning of May to support the yen after it fell to a 34-year low against the dollar, surpassing the total amount it used in 2022 to defend the currency.

Kanda timed the entry into the market to ensure that disclosure of the intervention didn’t take place for about a month. The finance ministry reveals how much it has spent in the currency markets at the end of each month.

After a rapid strengthening of the yen in October 2023, Kanda also refused to confirm at the time whether Japan had intervened. The sharp jolt in the market turned out to be the result of jittery markets and algorithmic trades combining to give the impression of intervention, an outcome that still served to raise the guard of speculators.

Kanda has also been wary of commenting too often on the currency to avoid giving hints to market players over when Tokyo will act. His term as the nation’s currency chief ends later this month.

Still, the latest move, if it proves to be intervention, would mark a new development of latching on to a strengthening move and then trying to extend it. While that might make it cheaper for Tokyo to move the currency pair by the usual margin of around 4 yen, it would also risk generating criticism from other major nations, including the US.

US Treasury Secretary Janet Yellen has repeatedly said that currency intervention should be a seldom-used tool that officials give fair warning about when they resort to it. Group of Seven nations have agreed not to tinker with exchange rates unless they are tamping down extreme volatility, she said in May.

Typically, Japan has used sharp weakening moves in a matter of hours to justify intervention and gain the tacit understanding of other countries. If it acted on Thursday, the move would follow more than two days with the dollar in the 161 range against the yen, hardly a sharp move threatening the stability of the economy.

Kanda didn’t agree when he was asked by reporters about whether the yen has been stable recently.

The currency official has talked about the impact of sharp devaluation over longer periods of time, referring to moves over two weeks, a month or since the start of the year. Japan’s import prices have recently risen by around 9.5%, of which 9.2% is down to the weakness of the yen, he said.

“Objectively looking we can at the very least say there have been rapid movements and they have impacted people’s lives,” Kanda said. “We can never ignore the adverse impact on the nation’s people of the weak yen.”

--With assistance from Anya Andrianova.

(Adds more comments from Japan’s top currency official and additional background)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance