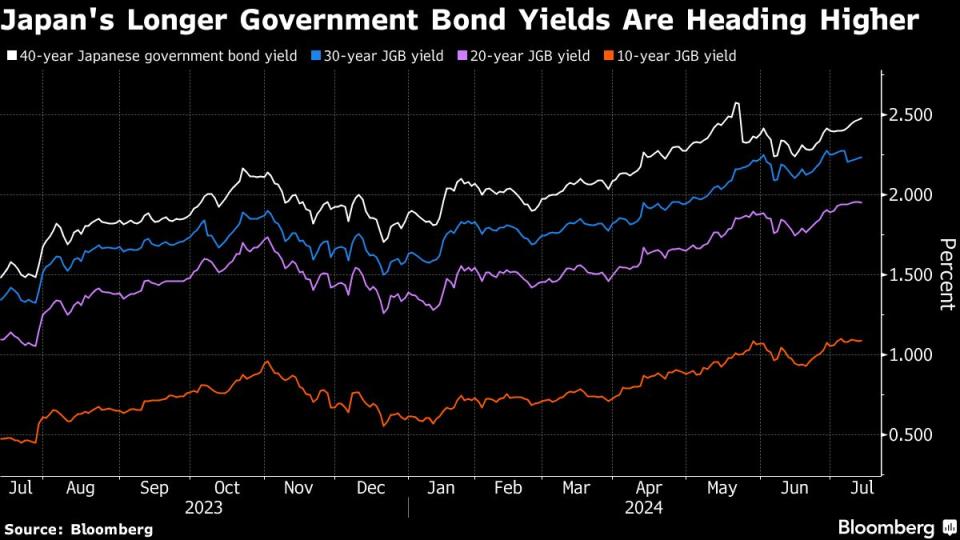

Japan’s 40-Year Government Bond Yields Hit 3% for First Time

(Bloomberg) -- Japan’s 40-year government bond yield touched 3% for the first time since this maturity was first issued in 2007.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Stocks See Big Rotation as Yields Sink on Fed Bets: Markets Wrap

As domestic life insurers who are usually big buyers stayed cautious ahead of the Bank of Japan’s July 31 policy decision, selling pressure came from market players including overseas investors.

While the most recently-issued 40-year bond’s yield stayed below 3%, three older JGBs with that tenor saw their yields rise to that level on Wednesday, and the rates have shown few signs of falling on Thursday in thin trading. The yen’s relentless weakening is increasing speculation that the BOJ will take further steps to normalize monetary policy soon, and major investors including life insurers are showing reluctance about parking their money in the debt.

Adding to the market’s bearishness, foreign investors sold Japanese medium- to long-term bonds on a net basis last week for the fourth consecutive week, matching the longest streak in about a year, according to Ministry of Finance data released Thursday. They also sold the most 10-year JGB futures in a month in the last week of June.

The yen’s slide to near fresh 38-year lows against the dollar is prompting some traders to bet that the BOJ will reduce bond buying and raise interest rates at the same time at its July 30-31 policy meeting, to support the home currency. But even that may not be enough to slow the yen’s decline, while it may push up bond yields, leading to even more debt selling by overseas investors.

Japan’s super-long bonds are “too cheap” now relative to overseas peers, but uncertainties about what kind of debt-buying reduction plan the BOJ will unveil at the end of the month are making it hard to buy the securities, said Tadashi Matsukawa, head of PineBridge Investments’ fixed income management department.

The BOJ likely won’t cut bond buying and raise rates at the same time considering that it’s avoided sudden bold moves in the past, going through the trouble of talking to market participants and taking a month and a half to make a decision, said Naomi Muguruma, chief fixed income strategist at Mitsubishi UFJ Morgan Stanley Securities.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance