Jacobs (J) to Compete for $80M DOD Contract, Fortifies Backlog

Jacobs Engineering Group Inc.’s J Government Services unit will compete with AECOM-HDR JV Design Team JV, NJ — a subsidiary of AECOM ACM — and other two for a certain firm-fixed-price contract from the U.S. Army Corps of Engineers, New York.

The scope of work is to provide general architect-engineering services. Each order is estimated at $80 million and is expected to be completed by November 2027.

Solid Project Execution to Drive Growth

Jacobs is witnessing a rising demand for infrastructure, water, environment, space, broadband, cybersecurity and life sciences consulting services. Efficient project execution has been a primary factor driving Jacobs’ performance over the last few quarters. The company’s solid backlog level is a testimony to this fact.

At the end of the fiscal fourth quarter, J reported a backlog of $27.9 billion, up 5% year over year. This reflects the persistent and solid demand for Jacobs' consulting services. Of this backlog, Critical Mission Solutions (CMS), accounted for $10.56 billion, slightly down from a year ago figure. Despite a slight decrease in backlog, the segment is benefiting from well-funded government programs and cyber, U.S. Department of Defense (DoD), mission-IT, space, nuclear and 5G-related projects.

People & Places Solutions (P&PS) backlog at fiscal third quarter-end was $17 billion, up from $15.74 billion a year ago. The P&PS segment’s overall sales pipeline has increased as both life sciences and electronics customers have moved forward with previously paused projects.

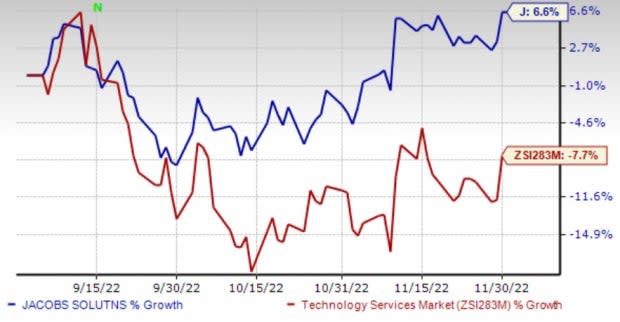

Image Source: Zacks Investment Research

J’s shares have outperformed the Zacks Engineering - R and D Services industry in the past three months. For fiscal 2022, net revenues increased 8.2% year over year and adjusted EPS grew 14%. It expects accelerating year-over-year net revenue growth through the fiscal 2023.

Jacobs’ Focus 2023 initiative entails more than $200 million in benefits versus fiscal 2020. Jacobs expects that by 2023, its transformative initiative, which will provide Jacobs with the flexibility to materially invest in the business, will drive growth through technology-enabled solutions. Earnings estimates for fiscal 2023 suggest 6.9% year-over-year growth.

Zacks Rank & About ACM

Currently, Jacobs carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AECOM, a Zacks Rank #3 (Hold) company, provides professional, technical and management solutions to diverse industries across end markets like transportation, facilities, government and environmental, energy and water businesses.

ACM’s expected earnings growth rate for fiscal 2022 is 22.7%.

Key Picks

Some top-ranked stocks in the Zacks Construction sector are CRH plc CRH and Janus International Group, Inc. JBI, both currently carrying a Zacks Rank #2 (Buy).

CRH manufactures cement, concrete products, aggregates, roofing, insulation and other building materials.

The company’s expected earnings growth rate for 2022 is 22.1%.

Headquartered in Temple, GA, Janus manufactures and supplies turn-key self-storage and commercial and industrial building solutions. Solid backlog levels, an impressive project pipeline, productivity improvements and commercial actions, including pricing, are expected to drive growth. The company is expected to benefit from its one-stop-shop offering with a leading market share position in self-storage doors and related design and installation services.

Janus’ earnings for 2022 are expected to rise 21%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance