The J.M. Smucker (SJM) Looks Enticing on Strategic Excellence

The J. M. Smucker Company SJM is well-positioned to sustain its growth trajectory. The company’s diverse brand portfolio, effective pricing strategies and operational efficiencies have been working well. Sustained demand across brands and categories also keeps this food and beverage product company in good shape.

Core Strategies Aid

The J. M. Smucker’s strategic focus remains centered on core priorities, including driving commercial excellence, reshaping its portfolio, streamlining costs and leveraging organizational strengths. These strategies have not only enhanced in-store fundamentals but also bolstered brand performance. The company has been proactive in implementing inflation-justified pricing actions across all business segments.

Additionally, SJM is channeling resources to fuel sustainable growth in the pet food, coffee and snacking categories. Supply chain optimization and cost reduction initiatives further underline the company’s commitment to operational efficiency.

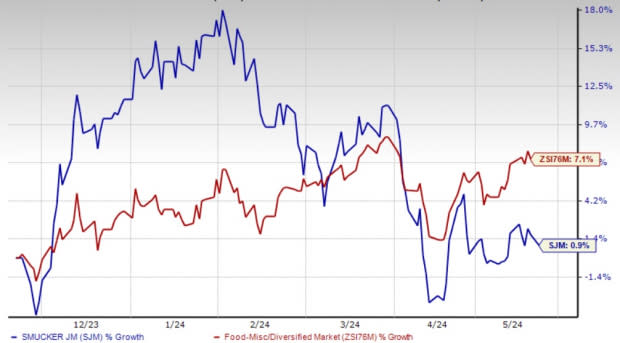

Image Source: Zacks Investment Research

Focus on Reshaping Portfolio

The J. M. Smucker's strategic portfolio reshaping through prudent acquisitions and divestitures has been pivotal. Recent moves in this regard include the acquisition of Hostess Brands, which is expected to contribute approximately $650 million to fiscal 2024 sales. The company’s historical acquisitions, such as Ainsworth and Big Heart Pet Brand, have reinforced its market presence and diversified its product range.

On the flip side, The J. M. Smucker divested the Canadian condiments business in January 2024 and Sahale Snacks in November 2023. These moves help the company focus its resources and portfolio on the pet food, snacking and coffee categories. Apart from this, partnerships with coffee giants like JDE Peet’s, Keurig Green Mountain (KGM) and Dunkin’ Brands Group further exemplify SJM’s strategic foresight.

Pricing, a Key Upside

The J. M. Smucker has demonstrated robust performance, driven by effective net price realization strategies across its diverse portfolio. In the third quarter of fiscal 2024, net price realization increased by 2%, significantly boosting comparable net sales. This upward pricing trend was particularly impactful in the U.S. Retail Pet Foods segment, where it contributed a seven-percentage-point boost to net sales. Similarly, the U.S. Retail Frozen Handheld and Spreads and the International and Away From Home units saw positive impacts of 5% and 4%, respectively.

For fiscal 2024, the company anticipates comparable net sales to rise 8.75% on elevated net pricing and a favorable volume/mix. Fourth-quarter comparable sales are expected to increase in the mid-single digits.

Wrapping Up

The J. M. Smucker is likely to keep up with its robust performance, thanks to its brand strength and pricing strategies. The integration of Hostess Brands is anticipated to enhance distribution capabilities and yield substantial cost synergies, contributing to long-term growth. Despite a dynamic consumer landscape and high SD&A costs, Smucker’s strategic initiatives and financial discipline underscore a promising future.

Shares of this Zacks Rank #2 (Buy) company have risen 0.9% in the past six months compared with the industry’s growth of 7.1%.

3 Other Appetizing Bets

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Ingredion Incorporated INGR, which manufactures and sells sweeteners, starches, nutrition ingredients and biomaterial solutions, currently carries a Zacks Rank #2. INGR has a trailing three-quarter earnings surprise of 10.1%, on average.

The Zacks Consensus Estimate for Ingredion Incorporated’s current fiscal year earnings indicates growth of 2.7% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks and currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance