Itron (ITRI) Q1 Earnings & Revenues Top Estimates, Rise Y/Y

Itron Inc ITRI reported non-GAAP earnings per share (EPS) of $1.24 for first-quarter 2024, which surpassed the Zacks Consensus Estimate by 45.9%. The company reported earnings of 49 cents in the prior-year quarter.

Revenues were $603 million, which beat the Zacks Consensus Estimate by 4.1%. The top line improved 22% (up 22% at constant currency) year over year.

The top-line performance was driven by strong operational execution and robust demand trends across all business segments. Management also noted that growth was backed by conversion of previously constrained revenues. ITRI had nearly $125 million of constrained revenues at the beginning of 2024. More than half of this amount was fulfilled in the first quarter.

Itron, Inc. Price, Consensus and EPS Surprise

Itron, Inc. price-consensus-eps-surprise-chart | Itron, Inc. Quote

Product revenues were $527.8 million (87.5% of total revenues), up 26.8% year over year. Service revenues totaled $75.6 million (12.5%), down 3.4% from the year-ago levels.

Itron’s bookings were $361 million and its backlog amounted to $4.3 billion at the end of the reported quarter.

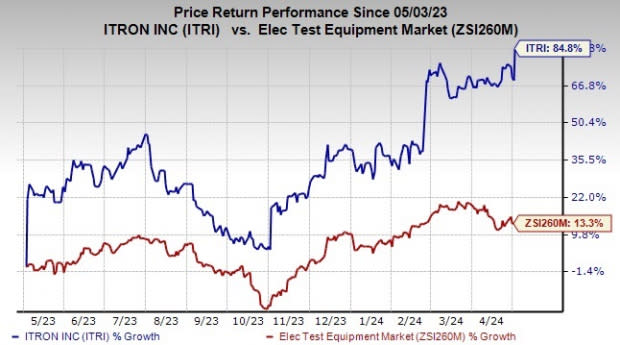

Following the better-than-expected results, shares rose 9.1% and closed trading session at $99.82 on May 2. In the past year, shares have risen 84.8% compared with sub-industry’s growth of 13.3%.

Image Source: Zacks Investment Research

Segments in Detail

Device Solutions: Revenues were $127 million (21% of total revenues), up 7% year over year due to higher demand for smart water meter and communication module sales. Our estimate was pegged at $130.3 million.

Networked Solutions: Revenues totaled $408 million (67.5%), up 30% year over year, driven by improved component supply, and increasing current and new project deployments. We suggested the metric to be $374.9 million.

Outcomes: Revenues of $69 million (11.5%) improved 10% on a year-over-year basis due to higher recurring and one-time services revenues. Our projection was $72.4 million.

Operating Details

Itron’s gross margin was 34%, which expanded 240 basis points on a year-over-year basis. Favorable mix and operational efficiency resulted in the uptick.

Non-GAAP operating expenses of $138.1 million jumped 10.4% year over year, primarily due to higher sales, general and administrative costs

Non-GAAP operating income was $67.3 million compared with $31.3 million in the year-ago quarter. The upside was driven by higher gross profit.

Balance Sheet & Cash Flows

As of Mar 31, 2024, cash and cash equivalents totaled $300.6 million compared with $302.1 million as of Dec 31, 2023. Accounts receivables were $340 million compared with $303.8 million in the prior quarter.

As of Mar 31, net long-term debt was $455.4 million compared with $454.8 million as of Dec 31, 2023.

Itron generated $41.3 million of cash from operations in the reported quarter against $1.43 million cash generated from operations in the prior-year quarter.

Free cash flow was $34.2 million against $5.5 million free cash outflow in the year-earlier quarter.

Guidance

For the second quarter of 2024, ITRI expects revenues to be between $595 million and $605 million.

Non-GAAP EPS is anticipated to be in the range of 90 cents-$1.00.

Zacks Rank and Key Picks

Currently, Itron carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth consideration in the broader technology space are Badger Meter BMI, Salesforce CRM and The Descartes Systems Group Inc DSGX. While BMI sports a Zacks Rank #1 (Strong Buy), CRM and DSGX carry a Zacks Rank of 2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS is pegged at $3.89, up 9.9% in the past 60 days. The long-term earnings growth rate is 15.6%.

BMI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 12.7%. Shares of BMI have soared 37.9% in the past year.

The Zacks Consensus Estimate for CRM’s fiscal 2025 EPS is pegged at $9.71. Salesforce’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 5.1%.

The long-term earnings growth rate for CRM is 17.4%. Shares of CRM have gained 41.3% in the past year.

The Zacks Consensus Estimate for DSGX’s fiscal 2025 EPS has increased 3% in the past 60 days to $1.69. Descartes earnings beat the Zacks Consensus Estimate in two of the last four quarters, while missing in the remaining two quarters, the average surprise being 5.1%. Shares of DSGX have gained 27.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

The Descartes Systems Group Inc. (DSGX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance