Iron Mountain (IRM) to Post Q3 Earnings: What's in the Cards?

Iron Mountain Incorporated IRM is set to release third-quarter 2022 results on Nov 3 before the bell. The company’s quarterly results are likely to display year-over-year growth in revenues and funds from operations (FFO) per share.

In the last reported quarter, this real estate investment trust (REIT) delivered a surprise of 1.09% in terms of adjusted FFO per share. Its results reflected robust performance in the storage and service segments, and the data-center business.

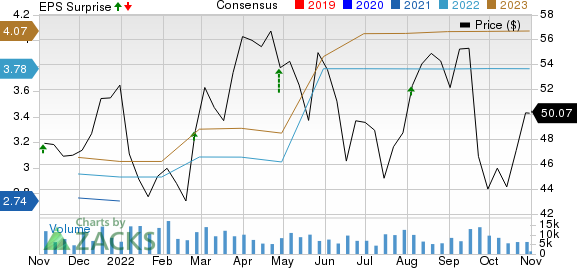

Over the trailing four quarters, Iron Mountain’s FFO per share surpassed the Zacks Consensus Estimate on each occasion, the average beat being 9.55%. The graph below depicts this surprise history:

Iron Mountain Incorporated Price, Consensus and EPS Surprise

Iron Mountain Incorporated price-consensus-eps-surprise-chart | Iron Mountain Incorporated Quote

Factors to Note

Iron Mountain has a stable and resilient business. It derives the majority of its revenues from fixed periodic (usually earned on a monthly basis) storage rental fees charged to customers based on the volume of their records stored. It has also enjoyed a consistent customer retention of more than 98% over the years. These factors are likely to have aided the company’s storage rental revenues during the quarter to be reported.

The Zacks Consensus Estimate for storage rental revenues is pegged at $762.7 million, suggesting an improvement of 1.3% from the prior quarter’s $753 million and 6.1% from the year-ago period’s $719 million.

Also, Iron Mountain’s service revenues, which comprise charges for related core service activities and a wide array of complementary products and services, are expected to have improved during the quarter.

The consensus estimate for service revenues is pegged at $547.9 million, indicating a rise of 2.2% from the prior quarter’s $536 million and an increase of 32.9% from the year-ago quarter’s $412 million.

IRM is anticipated to have continued expanding its fast-growing businesses, especially the data center segment, to supplement its storage segment performance during the quarter. Further, strong demand for connectivity, interconnection and colocation space is likely to have driven data center leasing activity.

In its second-quarter earnings presentation, management projected total revenues to be around $1.3 billion, adjusted EBITDA to be roughly $465 million and AFFO to be nearly $280 million for the third quarter.

The consensus estimate for total revenues for the third quarter is pegged at $1.32 billion, suggesting a year-over-year increase of 16.5%.

IRM’s capital-recycling efforts and a solid balance sheet are anticipated to have aided the company’s acquisition and development activities during the quarter.

However, as a major part of the company’s business lies outside the United States, the strengthening of the U.S. dollar might have been a matter of concern during the quarter.

Iron Mountain’s activities in the third quarter were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate of 96 cents for the quarterly FFO per share has remained unchanged over the past month. Nonetheless, the figure suggests a year-over-year increase of 33.3%.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an FFO beat for IRM this time. The right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that is not the case here.

Earnings ESP: Iron Mountain has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Iron Mountain currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks That Warrant a Look

Here are some stocks that are worth considering from the REIT sector, as our model shows that these have the right combination of elements to deliver a surprise this reporting cycle:

Host Hotels & Resorts HST is scheduled to report quarterly figures on Nov 2. HST has an Earnings ESP of +0.71% and a Zacks Rank of 2 (Buy) currently.

Park Hotels & Resorts PK is slated to report quarterly figures on Nov 2. PK has an Earnings ESP of +2.50% and a Zacks Rank of 3 currently.

Douglas Emmett DEI is scheduled to report quarterly figures on Nov 3. DEI has an Earnings ESP of +0.65% and a Zacks Rank of 3 currently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Douglas Emmett, Inc. (DEI) : Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance