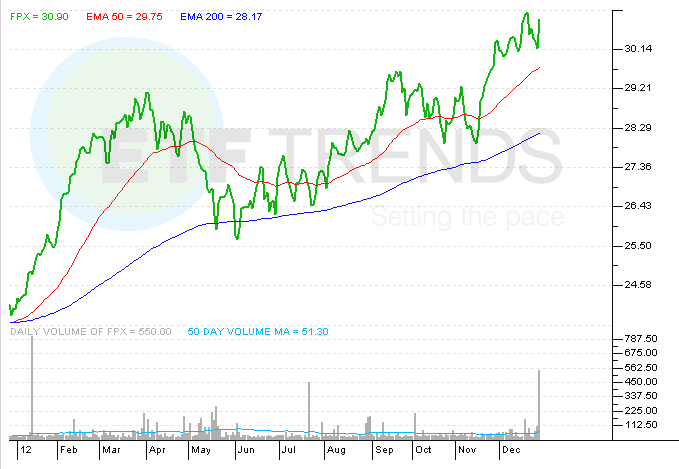

IPO ETF Beats S&P 500 with 30% Rally Despite Facebook Flop

Facebook’s (FB) initial public offering last year was a disaster but that didn’t stop First Trust US IPO Index ETF (FPX) from handily beating the market in 2012. The ETF nearly doubled the return of the S&P 500, gaining 30.5% compared with a 16% advance for the blue-chip index, according to Morningstar.

“The fund’s year-to-date returns are markedly better than if an investor was able to buy every IPO in the U.S. this year at the offer price and hold it, a strategy that would have netted a 17% return through Thursday,” according to Renaissance Capital, IPO research and investment firm.

There are about 1,000 domestic and international equity ETFs currently trading, with FPX the lone IPO-focused fund available on the market, reports Chris Dieterich for The Wall Street Journal. [Facebook: Which ETFs Will Like It]

Overall data has proven that the market performance of many IPO’s tend to lag. Data by Jay Ritter, finance professor at University of Florida found that between 1970 and 2010, IPO’s trailed equities on a 3.3% average five years after issuing shares, minus the first day gain, reports Dieterich. [Facebook Enters Social Media ETF]

Select smaller IPOs that fly under the radar do seem to create impressive total returns for investors willing to invest in new businesses as they go public, reports ETA Base.

The success of FPX has to do with the tracking benchmark’s selective process. The spinoffs within the index are not cash-hungry start-ups, rather they are big holdings from established companies. For example, Phillipps 66 (PSX), Visa Inc. (NYSE: V), General Motors Co. (GM) and Facebook (FB) are all included. [Tom Lydon Says Facebook to Join These ETFs]

FPX launched in 2006, and has about $21.4 million in assets under management. The expense ratio is 0.60% and the ETF has a 1.75% yield. [ETF Chart of the Day: IPOs]

First Trust US IPO Index ETF

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Yahoo Finance

Yahoo Finance