Investors in Very Good Food (CVE:VERY) have made a notable return of 99% over the past year

The Very Good Food Company Inc. (CVE:VERY) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! After all, the share price is up a market-beating 99% in that time.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Very Good Food

Because Very Good Food made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Very Good Food's revenue grew by 520%. That's a head and shoulders above most loss-making companies. While the share price gain of 99% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Very Good Food in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

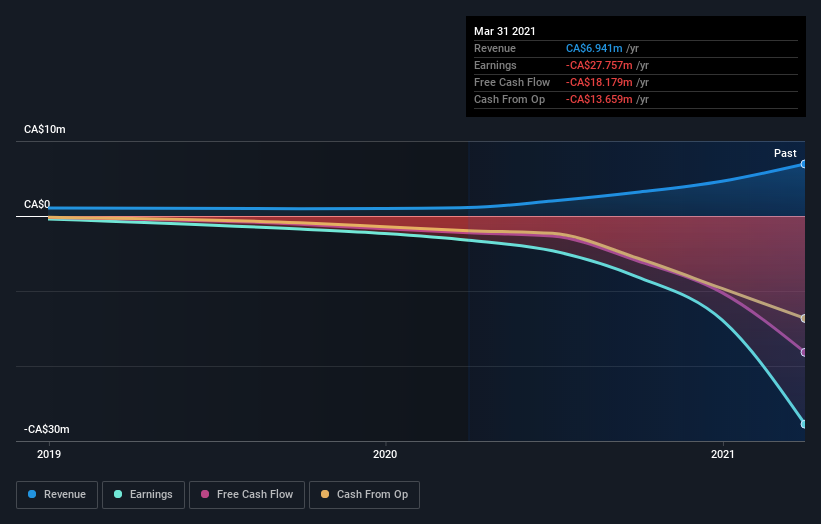

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Very Good Food's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Very Good Food boasts a total shareholder return of 99% for the last year. Unfortunately the share price is down 17% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Very Good Food has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

We will like Very Good Food better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance