Investors Sour on Chinese Stocks as Plenum Seen Lacking Potency

(Bloomberg) -- Sentiment toward Chinese stocks has deteriorated ahead of a key political gathering as traders remain wary about betting on a policy-driven turnaround.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

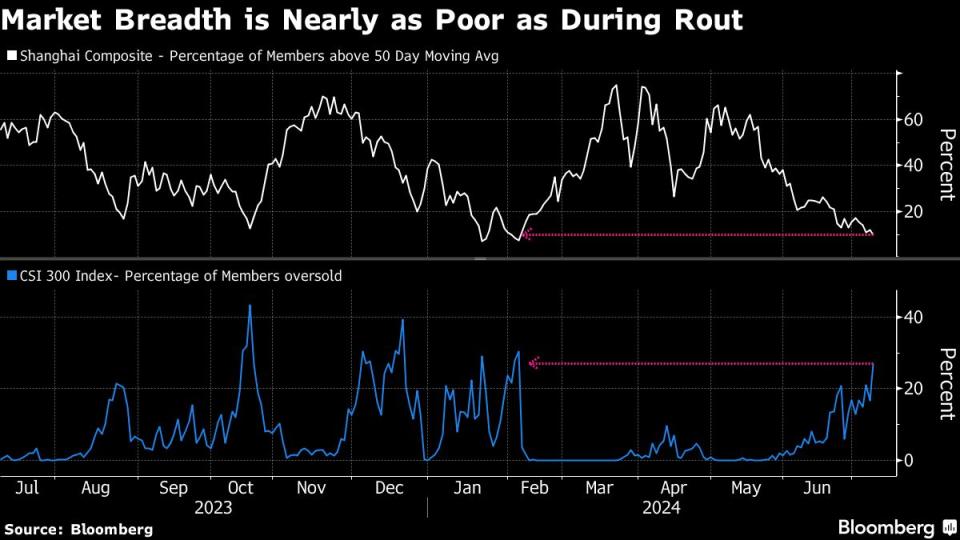

Onshore shares have slumped since mid-May as renewed trade tensions, a persistent property crisis, and a thriftier consumer base darken the outlook for growth. While benchmarks still trade above levels seen during the February rout, some indicators suggest sentiment is almost as sour as it was back then.

Expectations that a resolution to those woes will emerge from the Third Plenum, which convenes next week, are subdued. The once-in-five-years gathering discusses broader economic policies and long-term reform agenda rather than any quick fixes to a market slump.

China does have the firepower to end its housing crisis with a “big-bang solution,” according to Bloomberg Economics. But it’s unlikely to pull the trigger.

“The consensus among investors is that there is almost nothing when it comes to policies unveiled at the meeting that could be potent enough to turn around sentiment,” said Yang Tingwu, partner at Fujian Tongheng Investment Ltd. “On the flip side, that also means there won’t be much of a disappointment regardless of what the Plenum brings.”

Here are four charts showing the dire mood in the stock market.

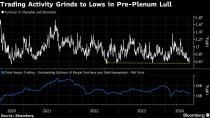

Trading has thinned as stocks lost momentum, pushing turnover in Shanghai and Shenzhen this week down to levels seen during previous routs.

Trading activity is as sluggish as it was in late September 2022, which was also just before the 20th Party Congress. Back then, investor skepticism was at its peak due to harsh Covid lockdowns. It also matches levels seen during December that year, when a sudden removal of pandemic restrictions spurred nationwide infections and kept traders at home.

Outstanding margin balance, often read as a proxy for risk appetite, has also edged lower though it remains higher than earlier this year.

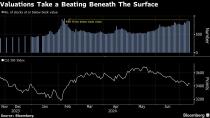

While the benchmark CSI 300 Index remains 8% above its February nadir, the valuation picture is nearly as bleak. Some 856 companies in Shanghai and Shenzhen bourses traded below book value on Wednesday versus 930 during the depth of the rout.

The number of firms trading below that threshold has been rising over the past couple of months as small firms with weak financial health continue to be sold off. Concerns include potential some will be delisted following a shift in the regulatory stance.

Read: China’s Small Caps Gain as CSRC Seeks to Ease Delisting Concerns

Another indicator shows it’s not just the health of smaller companies that’s worrying. More than a quarter of the members on the CSI 300 Index hit oversold levels this week, nearing the amount seen in February. Meanwhile, a little over 10% of Shanghai Composite members are trading above their 50-day moving averages, another sign of poor market breadth.

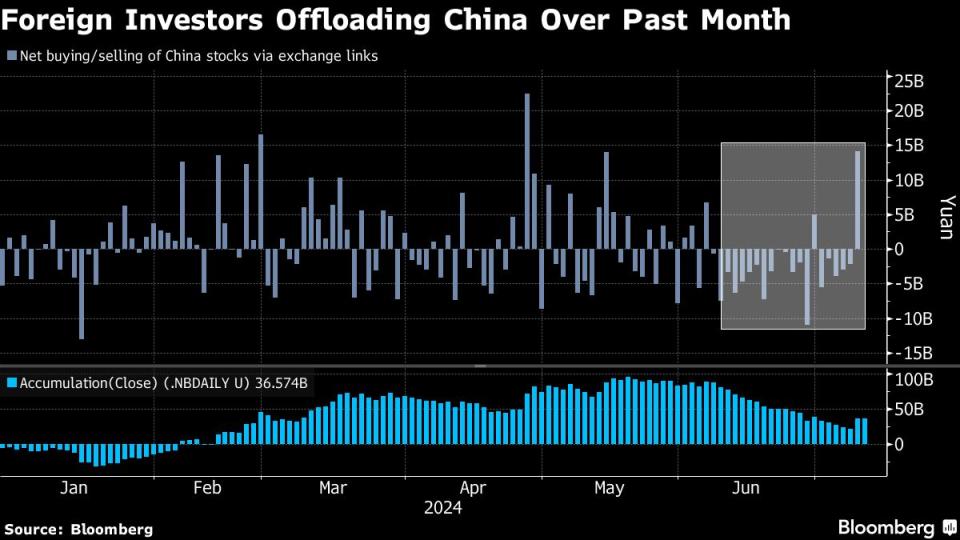

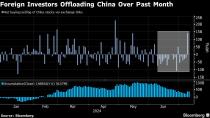

The loss of momentum and a dearth of catalysts have led foreign investors to sell in all but three sessions over the past month through Tuesday. If the trend continues, July would be a second month of withdrawals and potentially flip year-to-date flows to the negative. That’s in sharp contrast to a bout of inflows during February to May.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance