Investors in Pointerra (ASX:3DP) have made a fantastic return of 547% over the past five years

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Pointerra Limited (ASX:3DP) share price. It's 547% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. It's down 2.2% in the last seven days. Anyone who held for that rewarding ride would probably be keen to talk about it.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Pointerra

Pointerra isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Pointerra can boast revenue growth at a rate of 71% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 45% per year in that time. It's never too late to start following a top notch stock like Pointerra, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

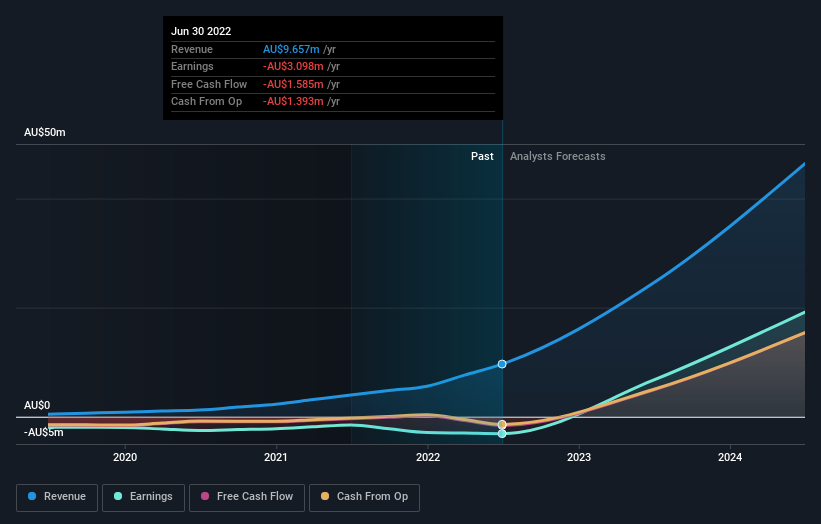

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Pointerra stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Pointerra shareholders are down 41% for the year. Unfortunately, that's worse than the broader market decline of 4.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 45% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance