What Investors Should Know About Scorpio Bulkers Inc.'s (NYSE:SALT) Financial Strength

While small-cap stocks, such as Scorpio Bulkers Inc. (NYSE:SALT) with its market cap of US$331m, are popular for their explosive growth, investors should also be aware of their balance sheet to judge whether the company can survive a downturn. Given that SALT is not presently profitable, it’s vital to evaluate the current state of its operations and pathway to profitability. Let's work through some financial health checks you may wish to consider if you're interested in this stock. Nevertheless, this is not a comprehensive overview, so I’d encourage you to dig deeper yourself into SALT here.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

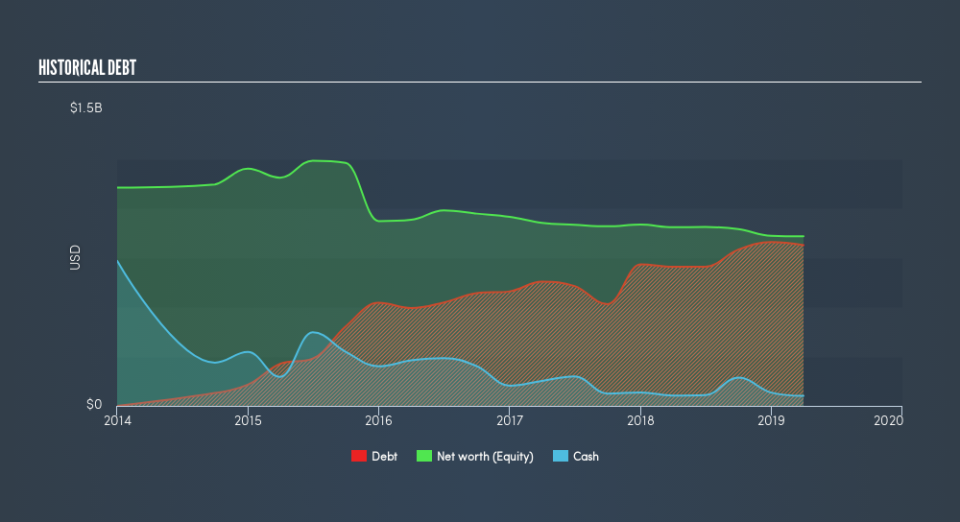

SALT’s Debt (And Cash Flows)

Over the past year, SALT has ramped up its debt from US$703m to US$814m , which accounts for long term debt. With this rise in debt, SALT currently has US$51m remaining in cash and short-term investments , ready to be used for running the business. Additionally, SALT has generated US$64m in operating cash flow during the same period of time, resulting in an operating cash to total debt ratio of 7.8%, indicating that SALT’s debt is not covered by operating cash.

Can SALT pay its short-term liabilities?

With current liabilities at US$153m, the company may not be able to easily meet these obligations given the level of current assets of US$66m, with a current ratio of 0.43x. The current ratio is the number you get when you divide current assets by current liabilities.

Does SALT face the risk of succumbing to its debt-load?

SALT is a relatively highly levered company with a debt-to-equity of 95%. This is somewhat unusual for small-caps companies, since lenders are often hesitant to provide attractive interest rates to less-established businesses. But since SALT is presently unprofitable, sustainability of its current state of operations becomes a concern. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

Although SALT’s debt level is towards the higher end of the spectrum, its cash flow coverage seems adequate to meet debt obligations which means its debt is being efficiently utilised. Though its low liquidity raises concerns over whether current asset management practices are properly implemented for the small-cap. This is only a rough assessment of financial health, and I'm sure SALT has company-specific issues impacting its capital structure decisions. I suggest you continue to research Scorpio Bulkers to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for SALT’s future growth? Take a look at our free research report of analyst consensus for SALT’s outlook.

Valuation: What is SALT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SALT is currently mispriced by the market.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance