Investors Don't See Light At End Of SAI.TECH Global Corporation's (NASDAQ:SAI) Tunnel And Push Stock Down 55%

SAI.TECH Global Corporation (NASDAQ:SAI) shares have retraced a considerable 55% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

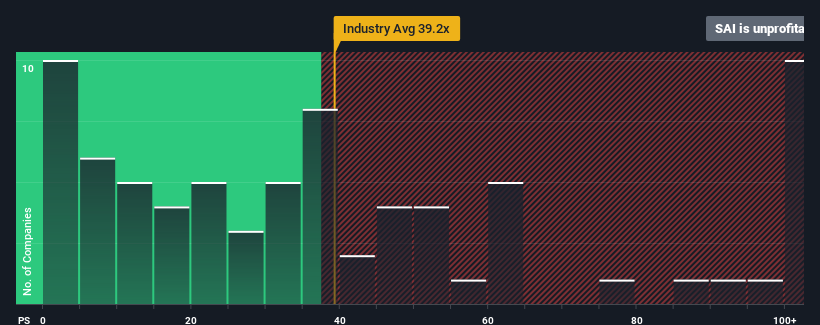

Although its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 15x, you may still consider SAI.TECH Global as a highly attractive investment with its -5.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for SAI.TECH Global as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for SAI.TECH Global

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SAI.TECH Global's earnings, revenue and cash flow.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, SAI.TECH Global would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 68%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 6.1% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that SAI.TECH Global's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On SAI.TECH Global's P/E

Shares in SAI.TECH Global have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that SAI.TECH Global maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for SAI.TECH Global (2 can't be ignored) you should be aware of.

If you're unsure about the strength of SAI.TECH Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance