Investors In Diamondback Energy, Inc. (NASDAQ:FANG) Should Consider This, First

Today we'll take a closer look at Diamondback Energy, Inc. (NASDAQ:FANG) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

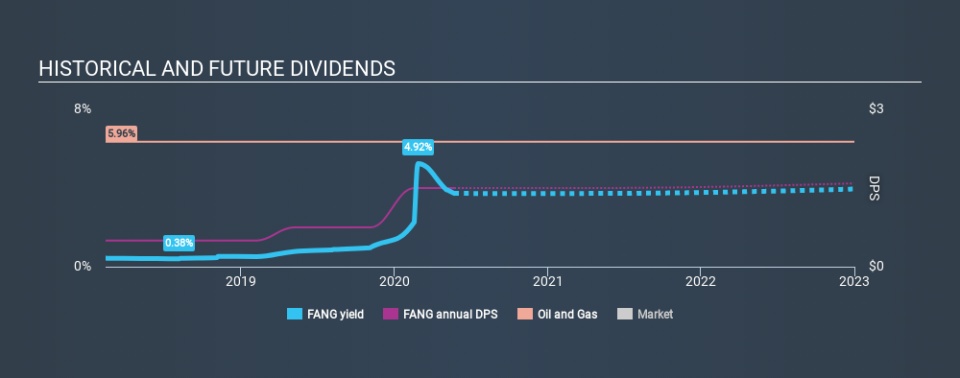

In this case, Diamondback Energy pays a decent-sized 3.5% dividend yield, and has been distributing cash to shareholders for the past two years. It's certainly an attractive yield, but readers are likely curious about its staying power. The company also returned around 15% of its market capitalisation to shareholders in the form of stock buybacks over the past year. Remember that the recent share price drop will make Diamondback Energy's yield look higher, even though recent events might have impacted the company's prospects. Some simple research can reduce the risk of buying Diamondback Energy for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although Diamondback Energy pays a dividend, it was loss-making during the past year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Last year, Diamondback Energy paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Is Diamondback Energy's Balance Sheet Risky?

Given Diamondback Energy is paying a dividend but reported a loss over the past year, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Diamondback Energy has net debt of 1.50 times its EBITDA, which we think is not too troublesome.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Diamondback Energy has EBIT of 9.06 times its interest expense, which we think is adequate.

Remember, you can always get a snapshot of Diamondback Energy's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past two-year period, the first annual payment was US$0.50 in 2018, compared to US$1.50 last year. Dividends per share have grown at approximately 73% per year over this time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Diamondback Energy has grown its earnings per share at 47% per annum over the past five years.

Conclusion

To summarise, shareholders should always check that Diamondback Energy's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Diamondback Energy's dividend is not well covered by free cash flow, plus it paid a dividend while being unprofitable. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. In summary, Diamondback Energy has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for Diamondback Energy that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance