Should Investors Buy Macy's (M) Stock Before the Holliday Season?

As the holiday season kicks off, Macy’s M shares continue to climb farther above their September lows. Still trading 28% from its highs, this week’s Black Friday shopping weekend could continue boosting Macy’s stock. More and more investors may be wondering if it’s time to buy the department store stock.

Let’s take a look at what’s been going on with Macy’s stock lately to get a better answer.

Recent Performance

Macy’s stock is up roughly 19% since blasting Q3 expectations last week. The company beat the Zacks Consensus Estimate by 173% with EPS at $0.52 per share. Its earnings were down 58% from the prior-year quarter, but somewhat impressive under challenging operating environments. Sales of $5.23 billion were down 3.9% YoY but beat top line expectations by 1%.

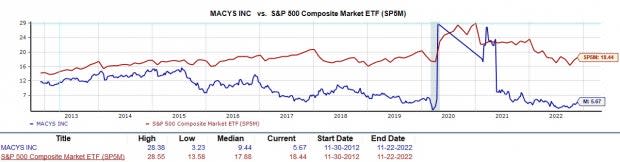

Image Source: Zacks Investment Research

Shares of Macy’s are now up 17% over the last month with better-than-expected October CPI numbers giving broader markets a push in recent weeks as well. Still, M stock has largely outperformed during this period as shown in the above chart.

The rally is much applauded as fears have mounted for years that e-commerce companies like Amazon AMZN and new-age retailers may slowly but surely put Macy’s out of business.

Outlook

Year over year, M’s earnings are now expected to drop -21% in its fiscal 2023 and another -3% in FY24 at $4.04 per share. Earnings estimates for FY23 have trended up after positive Q3 results last week while FY24 revisions have declined. The Zacks estimate for FY23 is now up to $4.17 per share compared to $4.14 a share while FY24 estimates have declined from $4.14 to $4.04 a share.

Sales are projected to be flat in FY23 and virtually flat in FY24 as well at $24.62 billion. FY24 sales projections would represent a -4% decrease from pre-pandemic levels, with 2019 sales at $25.73 billion. The declining growth has made some investors cautious about Macy’s ability to adapt and compete within the new age of retail. However, Macy’s stock is reasonably valued and is having a rebound-type performance over the last two years.

Performance & Valuation

Macy’s is down -10% YTD to outperform the S&P 500’s -17% and underperform the Retail-Regional Department Stores Market’s -3%. Still, Macy’s stock is up +123% over the last two years when including its solid dividend to crush the benchmark and beat its Zacks subindustry’s +117%.

Image Source: Zacks Investment Research

Trading around $23 a share, Macy’s has a forward P/E of 5.6X. This is below the benchmark and the industry average of 9X. The stock also trades at a discount to its decade-high of 28.3X and nicely below the median of 9.4X.

Image Source: Zacks Investment Research

Bottom Line

Macy’s currently lands a Zacks Rank #3 (Hold) and its Retail-Regional Department Stores Industry is in the top 7% of over 250 Zacks industries heading into the holiday season. Blasting Q3 expectations certainly opened a lot of eyes and have led to rising earnings estimates for Macy’s current fiscal 2023,

There could be better buying opportunities ahead after such a strong post-Q3 rally. However, investors may want to hold on to Macy’s shares during the holidays as the stock still trades attractively relative to its past despite its recent spike. The Average Zacks Price Target still suggests 6% upside from current levels and Macy’s offers patient investors a modest 2.67% annual dividend yield at $0.63 a share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macy's, Inc. (M) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance