Should Investors Buy the Dip in AMD (AMD) or Super Micro Computer's (SMCI) Stock After Earnings?

Despite exceeding their quarterly earnings expectations on Tuesday evening, AMD AMD and Super Micro Computer’s SMCI stock fell sharply in yesterday’s trading session. Still, corrections can be healthy and Super Micro shares have skyrocketed an astonishing +451% over the last year with AMD up +79%.

That said, investors may be wondering if there was an overreaction in the market and if it’s time to buy the post-earnings dip in these AI leaders with SMCI rebounding and rising +3% on Thursday and AMD up +1%.

Image Source: Zacks Investment Research

Overview

Given Nvidia’s NVDA stellar growth amid high demand for AI chips, investors may have been looking for more from AMD’s Q1 report. However, earnings of $0.62 per share did beat expectations that called for Q1 EPS to be at $0.60 a share and flat from the comparative quarter. Quarterly sales of $5.47 billion came in 1% above estimates and rose 2% from $5.35 billion in Q1 2023.

Image Source: Zacks Investment Research

Turning to Super Micro, the optimized server solutions provider had very lofty expectations given the mind-boggling price appreciation in its stock which has mirrored Nvidia's stellar performance. The company’s hype and growth have been substantial as Super Micro is an original equipment manufacturer of servers that can harvest AI.

Super Micro posted earnings of $6.65 per share for its fiscal third quarter beating expectations of $5.78 a share by 15%. More impressive, Super Micro’s Q3 EPS soared over 300% from $1.63 a share in the prior-year quarter. However, Q3 sales of $3.85 billion missed estimates of $3.96 billion by -3% although this was a 200% increase from $1.28 billion a year ago.

Image Source: Zacks Investment Research

Growth Trajectories

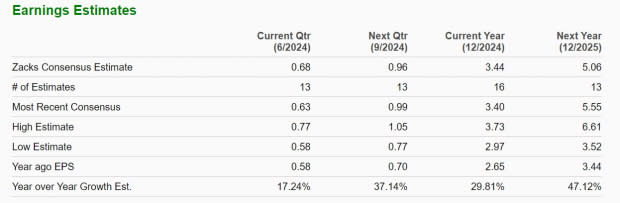

Based on Zacks estimates, AMD’s annual earnings are currently projected to increase 30% in fiscal 2024 and are forecasted to jump another 47% in FY25 to $5.06 per share. Total sales are forecasted to rise 11% this year and projected to climb another 23% in FY25 to $30.97 billion.

Image Source: Zacks Investment Research

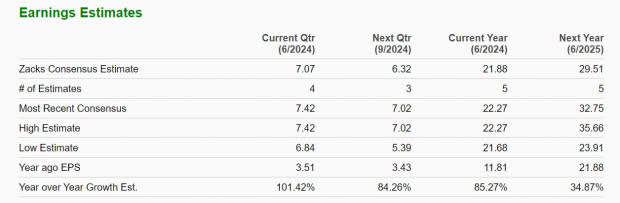

Pivoting to Super Micro, annual earnings are now expected to soar 85% in FY24 to $21.88 per share compared to $11.81 a share in 2023. Fiscal 2025 EPS is slated to jump another 35% to $29.51. Furthermore, Super Micro’s total sales are slated to increase 103% in FY24 and are projected to soar another 35% next year to $19.5 billion.

Image Source: Zacks Investment Research

Takeaway

Taking into account their blazing price performances over the last year, the post-earnings selloff in AMD and Super Micro Computer's stock wasn’t necessarily an overaction. However, their growth trajectories remain compelling with AMD’s stock sporting a Zacks Rank #2 (Buy) while Super Micro lands a Zacks Rank #3 (Hold) after such an extensive rally.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance