Investors Who Bought Prairie Provident Resources (TSE:PPR) Shares A Year Ago Are Now Down 62%

Investing in stocks comes with the risk that the share price will fall. And unfortunately for Prairie Provident Resources Inc. (TSE:PPR) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 62%. Prairie Provident Resources may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 20% in the last three months.

See our latest analysis for Prairie Provident Resources

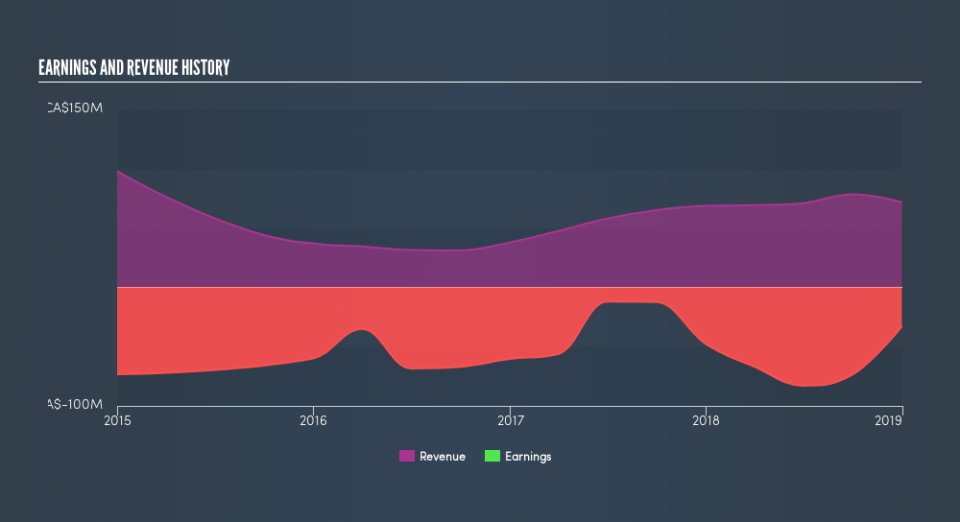

Because Prairie Provident Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Prairie Provident Resources increased its revenue by 4.6%. That's not a very high growth rate considering it doesn't make profits. Without profits, and with revenue growth sluggish, you get a 62% loss for shareholders, over the year. Like many holders, we really want to see better revenue growth in companies that lose money. When a stock falls hard like this, it can signal an over-reaction. Our preference is to wait for a fundamental improvements before buying, but now could be a good time for some research.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 6.0% in the last year, Prairie Provident Resources shareholders might be miffed that they lost 62%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 20%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before spending more time on Prairie Provident Resources it might be wise to click here to see if insiders have been buying or selling shares.

But note: Prairie Provident Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance