Investors Who Bought PetroTal (CVE:TAL) Shares A Year Ago Are Now Up 135%

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the PetroTal Corp. (CVE:TAL) share price has soared 135% return in just a single year. It's also good to see the share price up 92% over the last quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for PetroTal

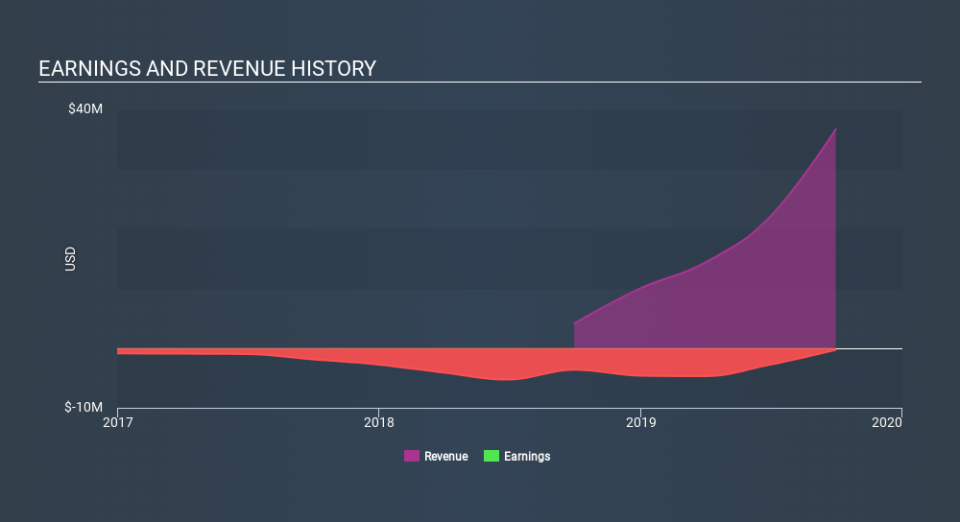

PetroTal wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

PetroTal grew its revenue by 784% last year. That's a head and shoulders above most loss-making companies. Meanwhile, the market has paid attention, sending the share price soaring 135% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling PetroTal stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

PetroTal shareholders should be happy with the total gain of 136% over the last twelve months , including dividends . A substantial portion of that gain has come in the last three months, with the stock up 92% in that time. This suggests the company is continuing to win over new investors. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like PetroTal better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance