Investors Who Bought IMPACT Silver (CVE:IPT) Shares Five Years Ago Are Now Up 494%

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. For example, the IMPACT Silver Corp. (CVE:IPT) share price is up a whopping 494% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 44% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for IMPACT Silver

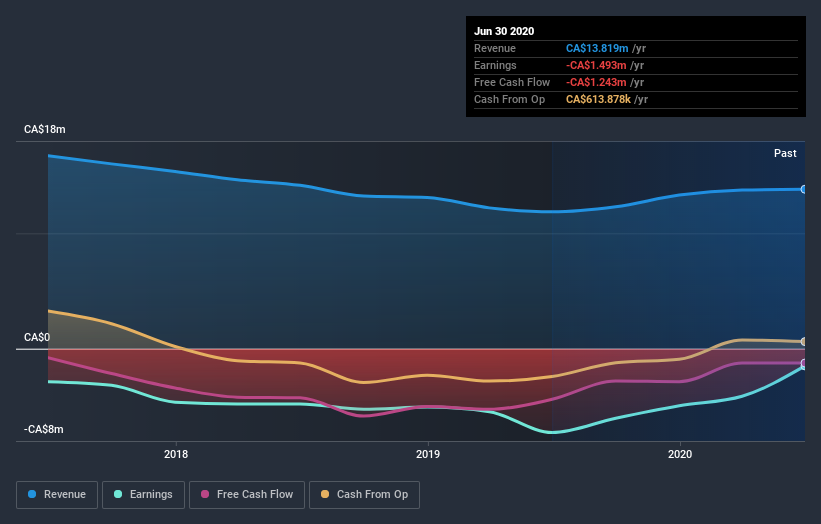

Given that IMPACT Silver didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade IMPACT Silver's revenue has actually been trending down at about 3.7% per year. So it's pretty surprising to see that the share price is up 43% per year. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on IMPACT Silver's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that IMPACT Silver has rewarded shareholders with a total shareholder return of 158% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 43% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand IMPACT Silver better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for IMPACT Silver you should be aware of, and 1 of them shouldn't be ignored.

We will like IMPACT Silver better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance