Investors Who Bought Eldorado Gold (TSE:ELD) Shares Five Years Ago Are Now Down 84%

It is doubtless a positive to see that the Eldorado Gold Corporation (TSE:ELD) share price has gained some 45% in the last three months. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Five years have seen the share price descend precipitously, down a full 84%. So we don’t gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

Check out our latest analysis for Eldorado Gold

Eldorado Gold isn’t a profitable company, so it is unlikely we’ll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

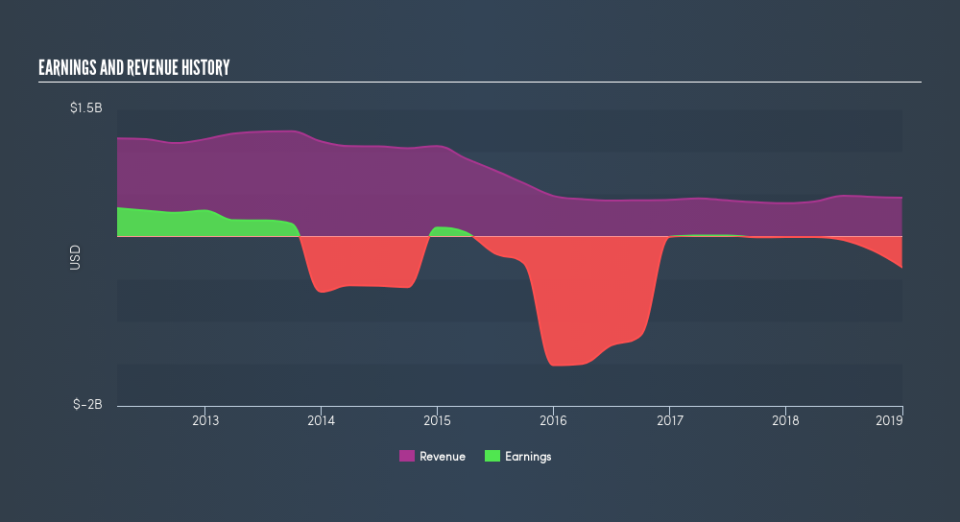

Over half a decade Eldorado Gold reduced its trailing twelve month revenue by 24% for each year. That puts it in an unattractive cohort, to put it mildly. So it’s not altogether surprising to see the share price down 31% per year in the same time period. We don’t think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor – but only if there are good reasons to predict a brighter future.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Eldorado Gold

A Different Perspective

Eldorado Gold shareholders are down 17% for the year, but the market itself is up 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 31% doled out over the last five years. We’d need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance