Investors Aren't Entirely Convinced By Guanajuato Silver Company Ltd.'s (CVE:GSVR) Revenues

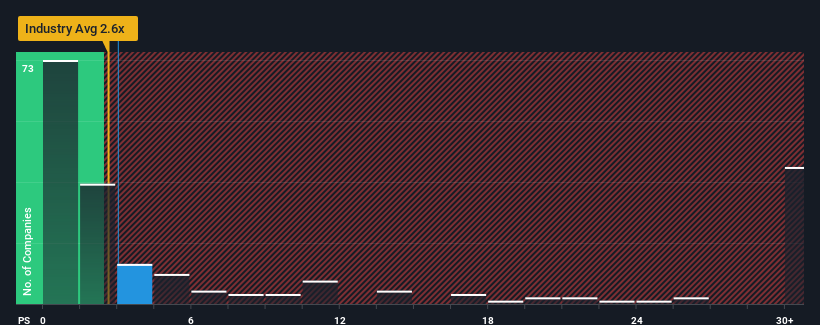

It's not a stretch to say that Guanajuato Silver Company Ltd.'s (CVE:GSVR) price-to-sales (or "P/S") ratio of 3x right now seems quite "middle-of-the-road" for companies in the Metals and Mining industry in Canada, where the median P/S ratio is around 2.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Guanajuato Silver

What Does Guanajuato Silver's P/S Mean For Shareholders?

Recent times have been advantageous for Guanajuato Silver as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guanajuato Silver.

How Is Guanajuato Silver's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guanajuato Silver's to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 58% each year over the next three years. With the industry only predicted to deliver 16% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Guanajuato Silver's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Guanajuato Silver's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Guanajuato Silver's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Guanajuato Silver has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Guanajuato Silver's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance