New Investors: 3 Simple Reasons to Buy ETFs

Written by Kay Ng at The Motley Fool Canada

New investors have lots to learn. They can take baby steps by starting to invest in exchange-traded funds (ETFs). ETFs originally came about as a passive investing instrument that follows the performance of an index for a very low fee. They give the opportunity for new investors who have just started saving and investing to build their wealth without getting a big cut on returns from fees.

Diversification

One advantage of investing in ETFs is the immediate diversification. When you buy one stock or bond, you’re exposed to that single security. When you first start investing, you might have little to invest. To avoid concentration risk in one security, you can choose to invest in an ETF that provides exposure to a basket of securities.

Warren Buffett, one of the best long-term investors in the world, thinks that consistently buying an S&P 500 (NYSE:SPY) low-cost index fund makes the most sense practically all of the time.

This is wise advice because the general stock market goes up in the long run. The S&P 500 fund, as the name implies, provides investors exposure to about 500 large-cap companies in the U.S. market. Similarly, in Canada, investors can consider the S&P/TSX 60 (TSX:XIU), which provides exposure to about 60 large-cap stocks across different sectors.

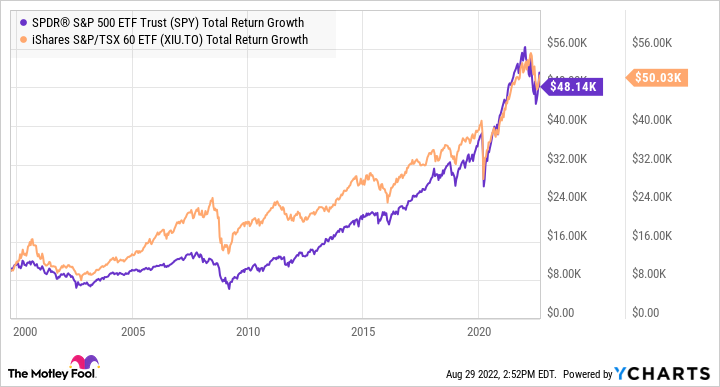

Here’s how an initial $10,000 investment has grown, in each of the market-wide ETFs, in the long run. An investment in XIU in this period resulted in annualized returns of about 7.6%.

SPY and XIU Total Return Level data by YCharts

Notably, you greatly reduce your risk through diversification when you invest in SPY or XIU ETFs but you’re still exposed to market risk. For example, you can see the “V-shaped” market crash in March 2020 in the graph above when the North American economies came to a halt during the pandemic. Government programs, including payouts to citizens who couldn’t work during the economic, shutdowns, and vaccine rollouts helped drive the strong rebound and subsequent market rally.

New investors need to be aware of these market corrections or crashes that will occur without warning and focus on long-term investing.

Low cost

ETFs that employ passive-investing strategies have low management expense ratios (MERs). SPY’s MER is 0.09%. XIU’s is 0.18%. Typically, passive ETFs have low MERs. ETFs that have MERs of more than 1% likely take on a more active investing approach.

New investors should consider investing for the long term in low-cost ETFs, such as adding to their SPY or XIU positions over time. The idea is that many years later, you expect the stock market to be much higher. What’s considered long-term investing? We’re looking at 5, 10, 20, 30, or even 40 years down the road. Potentially, ETFs can be a part of your retirement fund.

Notably, your investing platform may charge a trading fee. Scotiabank provides 103 commission-free trading ETFs for investors to explore. Other financial institutions may also provide commission-free trading for certain ETFs.

Keeping it simple

You can keep it really simple by only investing in SPY or XIU over time. There are also ETFs that provide exposure to specific sectors, industries, or bonds. In any case, they provide exposure to a basket of securities, which is much simpler to invest in than investing in securities one at a time. As a result, it’s also much simpler to manage an ETF investment portfolio.

The post New Investors: 3 Simple Reasons to Buy ETFs appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Spdr S&p 500 Etf Trust?

Before you consider Spdr S&p 500 Etf Trust, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2022 ... and Spdr S&p 500 Etf Trust wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 27 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/8/22

More reading

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends BANK OF NOVA SCOTIA.

2022

Yahoo Finance

Yahoo Finance