Investment Brokers' Q2 Earnings to Watch: PJC, WETF, SF

Over the last several quarters, investment banks (part of the broader Finance sector) performed decently with some quarterly volatility. However, this time around, the trend is likely to get reversed amid trading woes.

Asset managers are less likely to have received support from trading revenues as several concerns, like uncertainty related to Brexit and U.S.-China trade war, and expectations of global economic slowdown persisted. Also, the Fed’s accommodative policy stance led to ambiguity. All these factors weighed on investors’ mind and resulted in lower volatility. Thus, assets under management are expected to record a decline in second-quarter 2019.

The quarter also witnessed lower global M&A deal value and volume, which is likely to have resulted in lower advisory fees. Though equity underwriting business is anticipated to provide some support driven by rise in IPO activity, debt issuances remained soft.

On the cost front, as investment managers continue investing in technology to provide better services, operating expenses are likely to increase.

Per the latest Earnings Preview, overall earnings for the finance sector for the quarter are expected to grow 8.2% year over year. Also, revenues are projected to climb 6.4%.

Let’s take a look at three investment banking stocks that are scheduled to announce second-quarter results.

Piper Jaffray Companies PJC is set to report results before the opening bell on Jul 26. The Zacks Consensus Estimate for earnings is pegged at $1.05, indicating 14.1% growth from the year-ago reported figure. However, the consensus estimate for sales of $155.3 million suggests 10.5% decline.

With a Zacks Rank #3 (Hold) and Earnings ESP of 0.00%, chances of the company beating estimates in the quarter are low.

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

Piper Jaffray Companies Price and EPS Surprise

Piper Jaffray Companies price-eps-surprise | Piper Jaffray Companies Quote

WisdomTree Investments, Inc. WETF is expected to witness a fall in earnings and revenues in the second quarter. It is scheduled to release results on Jul 26, before the opening bell.

The Zacks Consensus Estimate for earnings of 6 cents suggests year-over-year decline of 33.3%. Also, the consensus estimate for sales of $67.8 million indicates a fall of 9.4%. With a Zacks Rank #3 and Earnings ESP of -4.27%, chances of WisdomTree beating the Zacks Consensus Estimate are low.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

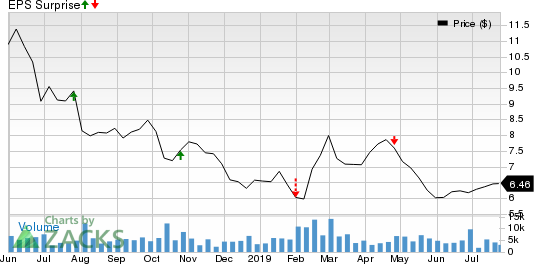

WisdomTree Investments, Inc. Price and EPS Surprise

WisdomTree Investments, Inc. price-eps-surprise | WisdomTree Investments, Inc. Quote

Stifel Financial Corporation SF is slated to announce results before market open on Jul 29. The company is projected to record year-over-year growth in earnings and revenues.

The Zacks Consensus Estimate for earnings of $1.34 suggests improvement of 9.8%. Also, the consensus estimate for sales of $776.5 million indicates 4.6% rise. With a Zacks Rank #4 (Sell) and Earnings ESP of 0.00%, chances of the company beating the Zacks Consensus Estimate are low.

Stifel Financial Corporation Price and EPS Surprise

Stifel Financial Corporation price-eps-surprise | Stifel Financial Corporation Quote

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stifel Financial Corporation (SF) : Free Stock Analysis Report

WisdomTree Investments, Inc. (WETF) : Free Stock Analysis Report

Piper Jaffray Companies (PJC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance