Invest in 5 Internet Software Stocks to Enhance Your Portfolio

The Internet Software and Services industry is gathering momentum owing to robust IT spending on solutions, which support hybrid operating environments. The level of technology adoption by businesses and the proliferation of connected consumer devices that might help people connect and do business online also accelerate the industry’s growth. Outstanding penetration of mobile devices among users, makes sense for businesses to invest heavily in web-based infrastructure, applications, and security software.

Within the technology sector, the Zacks Defined Internet-Software Industry is currently placed in the top 25% of all industries with a year-to-date return of 50%. The Internet software industry is benefiting from continued demand for a global digital transformation. Growth prospects are alluring primarily due to the rapid adoption of Software as a Service (SaaS), which offers flexible and cost-effective delivery of applications.

SaaS attempts to deliver applications to any user, anywhere, anytime and on any device. It has been effective in addressing customer expectations of seamless communications across multiple channels, including voice, chat, email, web, social media and mobile.

The growing need to secure cloud platforms amid rampant incidences of cyber-attacks and hacking is driving demand for web-based cybersecurity software. As enterprises continue to move their on-premise workload to cloud environments, application and infrastructure monitoring is gaining importance. This is increasing demand for web-based performance management monitoring tools.

Moreover, the pay-as-you-go model helps Internet software providers scale their offerings per the needs of different users. The subscription-based business model ensures recurring revenues for the industry participants.

At this stage, it will be prudent to invest in Internet software stocks with a favorable Zacks Rank to strengthen one’s portfolio.

Our Top Picks

We have narrowed our search to five Internet software stocks with strong potential for the rest of 2023. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

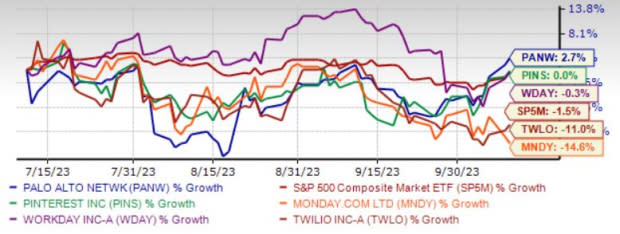

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Palo Alto Networks Inc. PANW has been benefiting from continuous deal wins and the increasing adoption of PANW’s next-generation security platforms, attributable to the rise in the remote work environment and the need for stronger security.

Zacks Rank #1 Palo Alto Networks has an expected revenue and earnings growth rate of 18.7% and 20.3%, respectively, for the current year (ending July 2024). The Zacks Consensus Estimate for current-year earnings has improved 7.7% over the last 60 days.

Pinterest Inc. PINS is making solid progress in deepening user engagement on the platform. Focus on improving operational rigor and integration of cutting-edge AI models will likely boost relevancy and personalization. The corporate strategy to introduce more actionable content on the platform from a wide range of sources has resulted in a healthy growth in engagement metrics across all regions.

PINS’ mobile deep linking product is helping retailers make more purchases through their mobile apps. PINS has significantly propelled shopping ads revenue growth. Advanced tools such as Travel Catalog and Premier Spotlight empower advertisers to reach target audiences with greater precision.

Zacks Rank #1 Pinterest has an expected revenue and earnings growth rate of 8.3% and 54.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.2% over the last 60 days.

monday.com Ltd. MNDY develops software applications in the United States, Europe, the Middle East, Africa, and internationally. MNDY provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

MNDY also offers product solutions for work management, sales CRM, software development verticals, business development, presale, and customer success services. It serves organizations, educational or government institutions, and distinct business units of an organization.

Zacks Rank #1 monday.com has an expected revenue and earnings growth rate of 37.9% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 58.6% over the last 60 days.

Twilio Inc. TWLO is benefiting from accelerated digital transformation amid a growing hybrid working trend. TWLO’s selective acquisitions and strategic investments in businesses and technologies are enhancing its product portfolio and fortifying its global presence.

TWLO is not only gaining traction from the solid expansion of its existing clientele but is also aided by first-time deals with new customers, supported by its firm focus on introducing products and the go-to-market sales strategy. We expect TWLO’s top line to witness a CAGR of about 8.3% from 2023-2025.

Zacks Rank #2 Twilio has an expected revenue and earnings growth rate of 5.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 23.2% over the last 60 days.

Workday Inc.’s WDAY revenue growth continues to be driven by high demand for its HCM and financial management solutions. WDAY’s cloud-based business model and expanding product portfolio have been the primary growth drivers.

Strong emphasis on the integration of generative AI in WDAY’s products and the development of various AI-driven applications to drive more value is a tailwind. Partnership expansion with Alight to deliver an integrated payroll experience to customers across Europe will likely strengthen its global footprint. In addition, Workday is expanding its portfolio beyond core HCM solutions into the financial domain.

Zacks Rank #2 Workday has an expected revenue and earnings growth rate of 16.1% and 53.3%, respectively, for the current year (ending July 2024). The Zacks Consensus Estimate for current-year earnings has improved 5.3% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance