Introducing Malibu Boats (NASDAQ:MBUU), The Stock That Zoomed 151% In The Last Three Years

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

It might be of some concern to shareholders to see the Malibu Boats, Inc. (NASDAQ:MBUU) share price down 14% in the last month. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. In fact, the share price is up a full 151% compared to three years ago. So the recent fall in the share price should be viewed in that context. The thing to consider is whether the underlying business is doing well enough to support the current price.

See our latest analysis for Malibu Boats

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

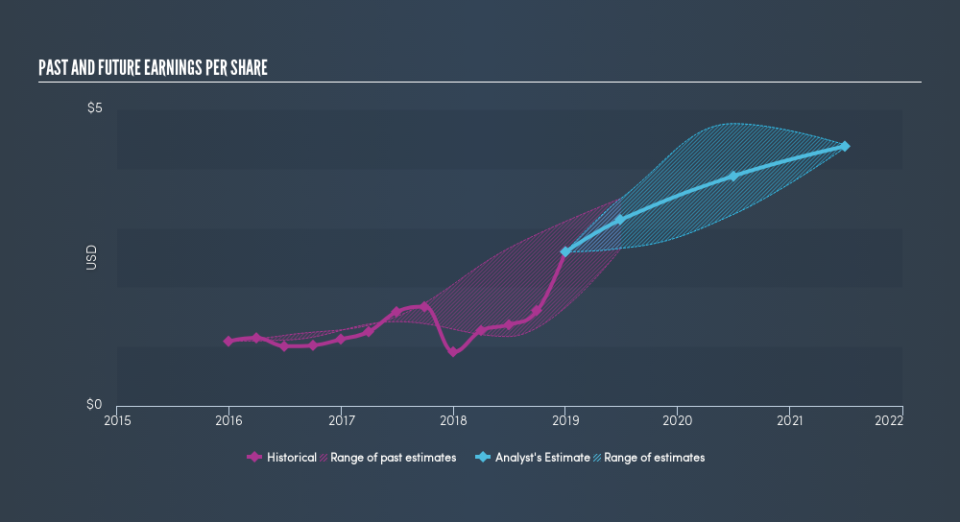

Malibu Boats was able to grow its EPS at 34% per year over three years, sending the share price higher. We note that the 36% yearly (average) share price gain isn't too far from the EPS growth rate. Coincidence? Probably not. This suggests that sentiment and expectations have not changed drastically. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Malibu Boats has grown profits over the years, but the future is more important for shareholders. This free interactive report on Malibu Boats's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Malibu Boats shareholders have received a total shareholder return of 22% over the last year. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research Malibu Boats in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance