Introducing INTL FCStone (NASDAQ:INTL), The Stock That Zoomed 126% In The Last Five Years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term INTL FCStone Inc. (NASDAQ:INTL) shareholders would be well aware of this, since the stock is up 126% in five years. Meanwhile the share price is 1.4% higher than it was a week ago.

View our latest analysis for INTL FCStone

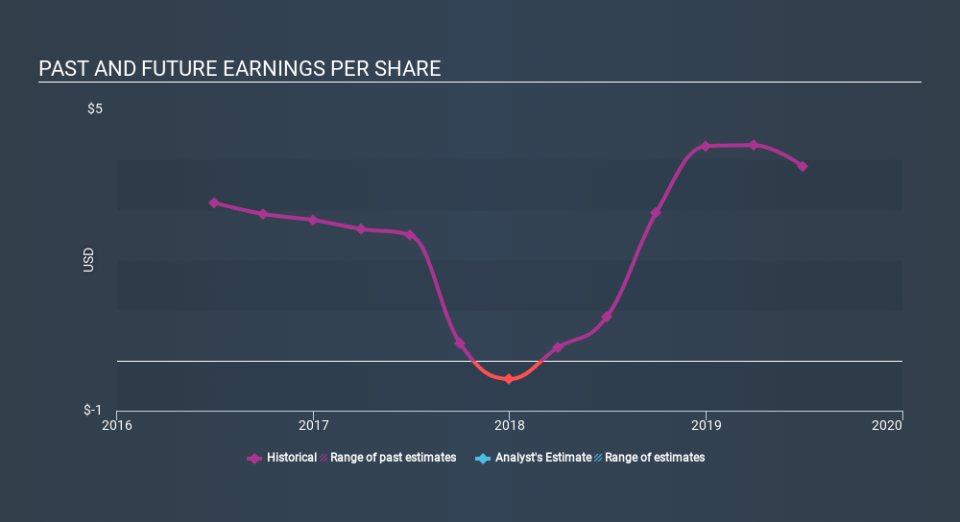

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, INTL FCStone managed to grow its earnings per share at 37% a year. The EPS growth is more impressive than the yearly share price gain of 18% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 10.52 also suggests market apprehension.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of INTL FCStone's earnings, revenue and cash flow.

A Different Perspective

INTL FCStone shareholders are up 2.5% for the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 18% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

INTL FCStone is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance