Introducing Anheuser-Busch InBev (EBR:ABI), The Stock That Dropped 22% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the Anheuser-Busch InBev SA/NV (EBR:ABI) share price up 13% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 22% in the last three years, falling well short of the market return.

Check out our latest analysis for Anheuser-Busch InBev

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Anheuser-Busch InBev actually managed to grow EPS by 16% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 8.2% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Anheuser-Busch InBev more closely, as sometimes stocks fall unfairly. This could present an opportunity.

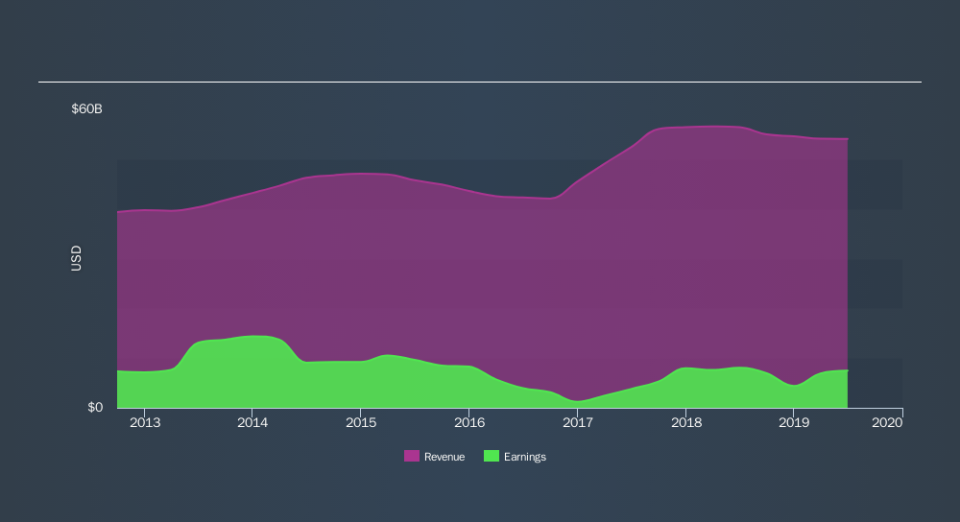

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Anheuser-Busch InBev is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Anheuser-Busch InBev stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Anheuser-Busch InBev, it has a TSR of -16% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Anheuser-Busch InBev shareholders have received a total shareholder return of 13% over one year. And that does include the dividend. That's better than the annualised return of 1.9% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Anheuser-Busch InBev cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance