Intouch Insight (CVE:INX) Shareholders Have Enjoyed An Impressive 109% Share Price Gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is Intouch Insight Ltd. (CVE:INX) which saw its share price drive 109% higher over five years. On top of that, the share price is up 21% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for Intouch Insight

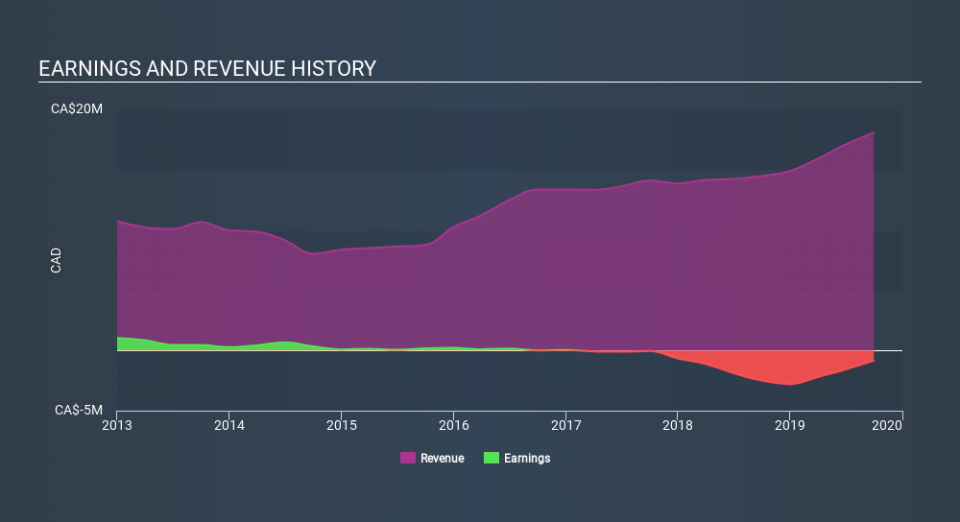

Intouch Insight isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Intouch Insight saw its revenue grow at 14% per year. That's a fairly respectable growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 16% per year over five years. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Intouch Insight's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Intouch Insight has rewarded shareholders with a total shareholder return of 15% in the last twelve months. However, the TSR over five years, coming in at 16% per year, is even more impressive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Intouch Insight by clicking this link.

Intouch Insight is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance