Internet of Things Stocks Q1 Recap: Benchmarking Arlo (NYSE:ARLO)

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at internet of things stocks, starting with Arlo (NYSE:ARLO).

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

The 7 internet of things stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1%. while next quarter's revenue guidance was 2.6% below consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and internet of things stocks have held roughly steady amidst all this, with share prices up 4.1% on average since the previous earnings results.

Arlo (NYSE:ARLO)

With its name deriving from the Old English word meaning “to see,” Arlo (NYSE:ARLO) provides home security products and other accessories to protect homes and businesses.

Arlo reported revenues of $124.2 million, up 11.9% year on year, in line with analysts' expectations. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates.

“Arlo continued its strong track record of execution, leveraging an innovative product portfolio and a steadily growing and highly profitable services offering to more than double its free cash flow to a record $19.5 million compared to the same period last year. Arlo’s $227 million in ARR drove remarkable leverage in the business and allowed us to improve our non-GAAP EPS by 8 cents year over year,” said Matthew McRae, Chief Executive Officer of Arlo Technologies.

The stock is up 20.9% since reporting and currently trades at $16.85.

Is now the time to buy Arlo? Access our full analysis of the earnings results here, it's free.

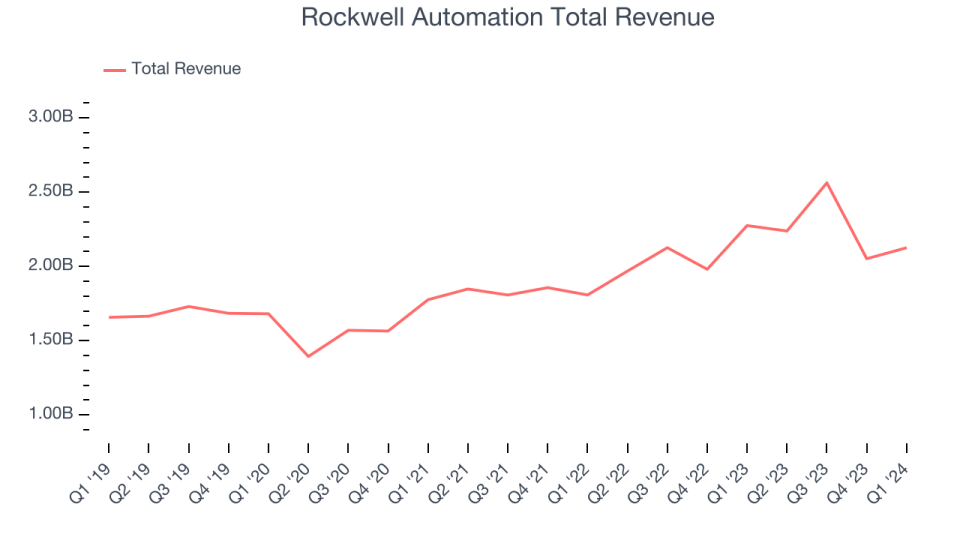

Best Q1: Rockwell Automation (NYSE:ROK)

One of the first companies to address industrial automation, Rockwell Automation (NYSE:ROK) sells products that help customers extract more efficiency from their machinery.

Rockwell Automation reported revenues of $2.13 billion, down 6.6% year on year, outperforming analysts' expectations by 3.5%. It was an exceptional quarter for the company with an impressive beat of analysts' organic revenue estimates and a decent beat of analysts' earnings estimates.

The market seems content with the results as the stock is up 2.5% since reporting. It currently trades at $284.61.

Is now the time to buy Rockwell Automation? Access our full analysis of the earnings results here, it's free.

Weakest Q1: SmartRent (NYSE:SMRT)

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

SmartRent reported revenues of $50.49 million, down 22.4% year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

SmartRent had the slowest revenue growth in the group. Interestingly, the stock is up 2% since the results and currently trades at $2.50.

Read our full analysis of SmartRent's results here.

Emerson Electric (NYSE:EMR)

Founded in 1890, Emerson Electric (NYSE:EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

Emerson Electric reported revenues of $4.38 billion, up 16.5% year on year, surpassing analysts' expectations by 2%. Taking a step back, it was a very strong quarter for the company with a decent beat of analysts' earnings estimates.

Emerson Electric achieved the fastest revenue growth among its peers. The stock is up 9.1% since reporting and currently trades at $117.15.

Read our full, actionable report on Emerson Electric here, it's free.

AMETEK (NYSE:AME)

Started from its humble beginnings in motor repair, AMETEK (NYSE:AME) manufactures electronic devices used in industries like aerospace, power, and healthcare.

AMETEK reported revenues of $1.74 billion, up 8.7% year on year, falling short of analysts' expectations by 2.4%. Revenue aside, it was a weak quarter for the company with a miss of analysts' organic revenue estimates.

AMETEK had the weakest performance against analyst estimates among its peers. The stock is down 1% since reporting and currently trades at $172.11.

Read our full, actionable report on AMETEK here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance