International Paper (IP) Q3 Earnings & Revenues Top Estimates

International Paper Company IP reported third-quarter 2020 adjusted earnings of 71 cents per share, which outpaced the Zacks Consensus Estimate of 48 cents. However, the bottom line declined 35% year over year from $1.09 reported in the prior year quarter. The downside was due to disappointing performances across all segments.

Including one-time items, the company posted earnings per share of 52 cents during the the third quarter of 2020 compared with the year-ago quarter’s 87 cents.

Net sales declined 8% to $5,123 million in the third quarter from the year-ago quarter’s $5,568 million. However, the top line surpassed the Zacks Consensus Estimate of $5,031 million.

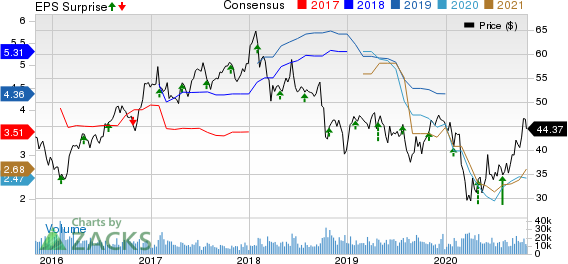

International Paper Company Price, Consensus and EPS Surprise

International Paper Company price-consensus-eps-surprise-chart | International Paper Company Quote

Cost of sales was $3,541 million, down from the prior-year quarter’s $3,772 million. Gross profit declined 12% year over year to $1,582 million. Selling and administrative expenses fell 6% year over year to $363 million during the reported quarter. Segment adjusted operating profit came in at $280 million, reflecting a year-over-year plunge of 35%.

Segment Performance

Industrial Packaging: Sales in this segment decreased 1% year over year to $3,768 million in the third quarter from the year-earlier quarter’s $3,820 million. Operating profit fell 12% year over year to $469 million.

Global Cellulose Fibers: This segment’s sales were $564 million in the third quarter, down 10% from the prior-year quarter. The segment incurred an operating loss of $59 million, against the year-ago quarter’s operating profit of $4 million.

Printing Papers: Sales of this segment came in at $743 million, down 31% from the $1,071 million reported in the year-earlier quarter. The segment’s operating profit plunged 61% year over year to $63 million in third-quarter 2020.

Financial Position

Cash and temporary investments aggregated $678 million as of Sep 30, 2020 compared with $511 million as of Dec 31, 2019. As of Sep 30, 2020, long-term debt was $8.5 billion compared with $9.6 billion as of Dec 31, 2019.

Cash flow from operating activities was $2.3 billion in the first nine-month period of 2020 compared with the $2.7 billion generated in the prior-year comparable period. Free cash flow was $616 million in the reported quarter compared with the prior-year quarter’s $597 million.

Price Performance

International Paper’s shares have fallen 6.6% year to date, compared with the industry’s decline of 10.3%.

Zacks Rank & Other Stocks to Consider

International Paper currently carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Agnico Eagle Mines Limited AEM, Barrick Gold Corporation GOLD and Newmont Corporation NEM. While Agnico Eagle Mines sports a Zacks Rank #1, Barrick Gold and Newmont carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle Mines has an expected earnings growth rate of 102% for the current year. The company’s shares have surged 24% year to date.

Barrick Gold has a projected earnings growth rate of 99% for the current year. The company’s shares have gained 39% year to date.

Newmont has an estimated earnings growth rate of 91% for the ongoing year. Its shares have appreciated 35% so far this year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Paper Company (IP) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance