InterDigital (IDCC) Renews Sony Patent License Agreement

InterDigital, Inc. IDCC recently extended its patent license agreement with Sony Corporation of America – the subsidiary of Japan-based Sony Group Corporation SONY, for an undisclosed amount. In addition to the patent renewal, the firms extended their Convida Wireless joint venture deal to continue their collaborative research in the fields of 5G and IoT.

Formed in 2013, Convida Wireless aims to leverage Sony's consumer electronics expertise and InterDigital's IoT know-how to drive new research in IoT communications and other connectivity areas. This, in turn, is likely to sow the seeds of future technologies for advancing 5G standards for high bandwidth and low latency applications. Sony’s patent renewal agreement will further enable it to strengthen its rich portfolio of assets in wireless technologies to better serve its customers.

InterDigital’s commitment to licensing its broad portfolio of technologies to wireless terminal equipment makers, which allows it to expand its core market capability, is laudable. It has leading companies, such as Huawei, Samsung, LG and Apple, under its licensing agreements. Consequently, the company expects to generate solid recurring revenues from the patent licensing business in the forthcoming quarters as well.

InterDigital’s global footprint, diversified product portfolio and its ability to penetrate different markets are impressive. Apart from the company’s strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses. Furthermore, the company remains committed to pursuing acquisitions to drive its product portfolio and boost organic growth.

The company is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. InterDigital aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT, and allied technology areas by leveraging its research and development capabilities, technological know-how and rich industry experience. At the same time, it intends to enhance its licensing revenue base by adding licensees and expanding into adjacent technology areas that align with its intellectual property position.

Additionally, more and more companies are increasingly offering the work-from-home option to employees to ensure their safety and wellbeing. Several firms are also providing a secure and connected workplace setup through quick onboarding and enablement services to support the seamless continuity of businesses and enable employees to fulfill their professional obligations. This, in turn, is likely to create new revenue-generating opportunities for InterDigital, as humans become solely dependent on the digital platform to stay connected not only for their professional lives but also for online education, shopping, dining and entertainment.

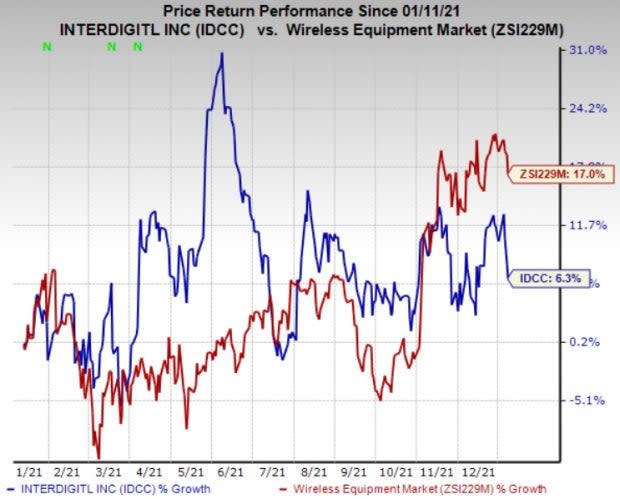

The stock has gained 6.3% over the past year compared with the industrys growth of 17%. Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

A better-ranked stock in the industry is Sierra Wireless, Inc. SWIR, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sierra Wireless has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters. Over the past year, it has gained 3.3%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Qualcomm Incorporated QCOM, carrying a Zacks Rank #2, is another solid pick for investors. It has a long-term earnings growth expectation of 15.3% and delivered an earnings surprise of 11.2%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 29.7% over the past year. Qualcomm is likely to benefit in the long run from solid 5G traction and a surge in demand for essential products that are the building blocks of digital transformation in the cloud economy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Sony Corporation (SONY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance