Interactive Brokers (IBKR) to Post Q2 Earnings: What to Expect

Interactive Brokers Group, Inc. IBKR is set to report second-quarter 2024 results on Jul 16, after market close. Its earnings and revenues in the quarter are expected to have improved year over year.

In the last reported quarter, Interactive Brokers surpassed the Zacks Consensus Estimate. Results benefited from higher total GAAP net revenues, growth in customer accounts and an increase in daily average revenue trades (DARTs).

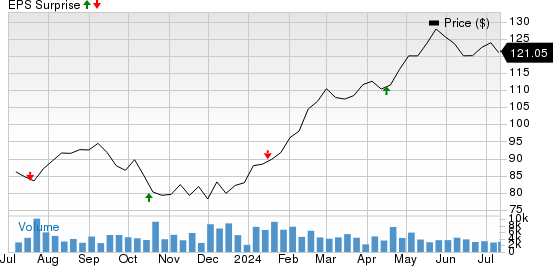

IBKR has a decent earnings surprise history. The company’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed in two.

Interactive Brokers Group, Inc. Price and EPS Surprise

Interactive Brokers Group, Inc. price-eps-surprise | Interactive Brokers Group, Inc. Quote

Earnings & Sales Projections for Q2

The Zacks Consensus Estimate for IBKR’s second-quarter earnings is pegged at $1.69 per share, up marginally over the past seven days. The estimate indicates a 28% jump from the year-ago quarter’s reported number.

The consensus estimate for total sales is pegged at $1.23 billion, suggesting a surge of 23.3% on a year-over-year basis.

Other Key Q2 Estimates

During the second quarter, client activity was robust, with the major indexes touching all-time highs several times. This, along with the steady rise in DARTs in each of the three months of the second quarter, is expected to have supported Interactive Brokers’ commission revenues. The Zacks Consensus Estimate for commission revenues is pegged at $398 million, indicating a 23.6% rise from the prior-year reported number.

Additionally, higher interest rates are expected to have immensely supported IBKR’s net interest income (NII) in the to-be-reported quarter. The Federal Reserve kept the interest rates unchanged at a 23-year high of 5.25-5.5% during the second quarter. Thus, the consensus estimate for NII is $765 million, implying a 10.2% increase.

The Zacks Consensus Estimate for other income stands at $13 million against other loss of $63 million in the prior-year quarter.

On the cost front, total operating expenses are likely to have remained elevated as IBKR invests in key areas to enhance platform capabilities, drive product innovation, improve customer support and build upon regulatory and compliance functions.

Earnings Whispers

Our quantitative model cannot conclusively predict an earnings beat for Interactive Brokers this time. This is because it doesn’t have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Interactive Brokers has an Earnings ESP of 0.00%.

Zacks Rank: The company currently sports a Zacks Rank #1 (Strong Buy).

Finance Sector Stocks Worth a Look

Here are a couple of finance sector stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time:

The Earnings ESP for Tradeweb Markets TW is +0.25% and it carries a Zacks Rank #2 (Buy) at present. The company is slated to report second-quarter 2024 results on Jul 25.

Over the past seven days, the Zacks Consensus Estimate for TW’s quarterly earnings has moved 1.5% north to 69 cents.

Ally Financial ALLY is scheduled to release second-quarter 2024 earnings on Jul 17. The company, which carries a Zacks Rank #3 at present, has an Earnings ESP of +2.67%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ALLY’s quarterly earnings estimates have remained unchanged at 61 cents over the past week.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Tradeweb Markets Inc. (TW) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance