Insulet (PODD) Awaits Q1 Earnings Release: Here's What to Expect

Insulet PODD is scheduled to report first-quarter 2024 results on May 9 after market close.

In the last reported quarter, the company’s adjusted earnings per share of $1.40 surpassed the Zacks Consensus Estimate by a remarkable 108.96%. Earnings beat estimates in each of the trailing four quarters, the average beat being 100.09%.

Let’s take a look at how things have shaped up prior to this announcement.

Factors at Play

In 2023, Insulet firmly established itself as the market leader in automated insulin delivery (AID), achieving its eighth consecutive year of above 20% revenue growth and dollar growth of nearly $400 million. With a strong momentum in 2024 and several catalysts ahead, the company is incredibly well-positioned for continued growth and can efficiently scale its business in each of the quarters of 2024.

In the first quarter, particularly, Insulet may have achieved significant margin expansion by leveraging its global market opportunities and investments in innovations. The company's focus on long-term value creation for shareholders and meeting customer commitments may have significantly favored its top-line performance in the quarter under review.

Insulet Corporation Price and EPS Surprise

Insulet Corporation price-eps-surprise | Insulet Corporation Quote

The Omnipod product platform is expected to deliver another quarter of robust revenues following its milestone of 25% growth in 2023 for its active global customer base. Strong U.S. Omnipod market growth may have been driven by the company’s annuity-based model and growing pharmacy volume, including an increasing volume contribution from the Omnipod 5 AID system and the related premium for pods in the U.S. pharmacy. Insulet’s breakthrough offering is a key driver of growth, further establishing its dominance and expertise in the diabetes market.

Furthermore, Omnipod 5 is likely to have represented a vast majority of new customer starts in the first quarter of 2024, along with strong customer retention. Nearly 250,000 customers are reported to have utilized Omnipod 5 last year. We assume the company to have capitalized on its biggest opportunity by shifting customers to Omnipod from MDI (multiple daily injections). Through driving continuous pump penetration and gaining share in both the type 1 and type 2 markets, Insulet may have further strengthened its leadership position and delivered robust revenues in the to-be-reported quarter.

Additionally, Omnipod 5’s broader appeal may have been demonstrated by a growing number of scripts written by healthcare providers. In February 2024, Insulet secured a major milestone by gaining CE Mark approval for Omnipod 5 integration with Abbott’s FreeStyle Libre 2 Plus Sensor. The company is likely to have progressed toward launching this integrated offering in the United Kingdom and the Netherlands in the first half of 2024.

Insulet also initiated its limited U.S. market rollout of Omnipod 5 with G7, aiming to test the market and scale up production for a successful full G7 market launch later this year. These developments are likely to have made a positive impact on its 2024 first-quarter performance.

Simultaneously, Omnipod DASH may have continued to hold its momentum in the Type 2 diabetes market. International Omnipod revenue growth is likely to have surpassed the company’s expectations for the to-be-reported quarter, backed by the continued strong Omnipod DASH adoption and Omnipod 5’s contribution in the U.K. and Germany.

Going by the Zacks Consensus Estimate, Insulet’s Total Omnipod revenues are expected to increase 17.9% year over year in the first quarter of 2024.

Q1 Estimates

The Zacks Consensus Estimate for the company’s first-quarter 2024 revenues is pegged at $423.5 million, which suggests an 18.3% rise from the year-ago reported figure.

The Zacks Consensus Estimate for the company’s first-quarter 2024 earnings per share of 39 cents indicates a staggering 69.6% increase from the year-ago reported figure.

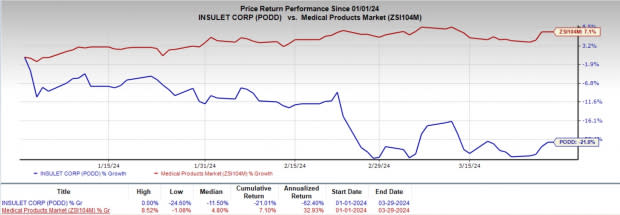

Price Performance

In the first quarter of 2024, Insulet shares have underperformed the industry. The stock has decreased 21% compared to the industry’s 7.1% rise.

Image Source: Zacks Investment Research

What Our Model Suggests

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP has higher chances of beating estimates, which is the case here:

Earnings ESP: Insulet has an Earnings ESP of +11.11%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Other Stocks Worth a Look

Here are some other medical stocks worth considering as these also have the right combination of elements to post an earnings beat this quarter:

TransMedics Group TMDX has an Earnings ESP of +240.00% and a Zacks Rank #1. The company is expected to release first-quarter 2024 results on May 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

TransMedics has an expected earnings growth rate of 81.8% for 2024. TMDX surpassed earnings in each of the trailing four quarters, the average being 107.83%.

Sarepta Therapeutics SRPT has an Earnings ESP of +104.86% and a Zacks Rank #2. The company is expected to release first-quarter 2024 results on May 7.

SRPT has an expected earnings growth rate of 136.7% for 2024 compared to the industry’s 13.3%. The company surpassed earnings in each of the trailing four quarters, the average being 464.56%.

HCA Healthcare HCA currently has an Earnings ESP of +13.46% and a Zacks Rank #2. The company is set to release its first-quarter 2024 results on Apr 26.

HCA has an expected long-term earnings growth rate of 10.1% compared to the industry’s 9.9%. The company surpassed earnings in three of the trailing four quarters and missed in one, the average being 9.78%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

TransMedics Group, Inc. (TMDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance