Insperity (NSP) Stock Dips 2% Despite Earnings Beat in Q2

Insperity, Inc. NSP reported solid second-quarter 2022 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

The stock has lost 2% since its earnings release on Aug 1. The downfall can be attributed to a weak third-quarter guidance. The adjusted EPS guidance for the June quarter is provided between 83 cents and $1.06 per share. The midpoint of the guided range (94 cents) is below the consensus estimate of $1.02.

Adjusted earnings (excluding 29 cents from non-recurring items) of $1.16 per share outpaced the Zacks Consensus Estimate by 17.2% and rose 27.5% year over year.

Revenues of $1.43 billion surpassed the consensus mark by 2.2% and increased 20.2% year over year. The upside was backed by a 1.2% increase in revenues per worksite employee (WSEE) and a 19.4% increase in paid worksite employees.

The average number of worksite employees paid per month, 290,507, increased 19.4% year over year.

Over the past year, shares of Insperity have gained 9.5% against the 9.9% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Operating Results

Gross profit grew 20.2% year over year to $239.9 million. The uptick was backed by the outperformance by paid WSEEs, favorable pricing, higher-than-expected contributions from each of the direct cost programs and traditional employment offerings. Gross profit per worksite employee per month inched up 0.7% year over year to $275.

Adjusted EBITDA increased 25% year over year to $75 million. Adjusted EBITDA per worksite employee per month rose 5% to $86.

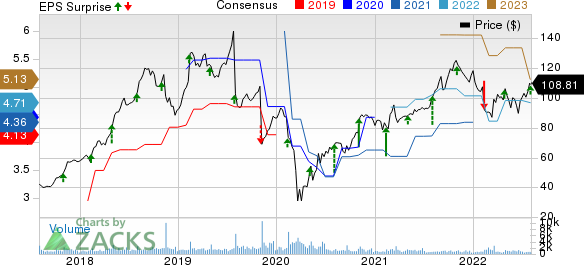

Insperity, Inc. Price, Consensus and EPS Surprise

Insperity, Inc. price-consensus-eps-surprise-chart | Insperity, Inc. Quote

Operating expenses increased 16.5% year over year to $191.5 million. Operating expenses per worksite employee per month dipped 2.2% to $220.

Operating income increased 37.3% year over year to $48.4 million. Operating income per worksite employee per month improved 14.6% to $55 million.

Balance Sheet & Cash Flow

Insperity exited second-quarter 2022 with adjusted cash, cash equivalents and marketable securities of $510.9 million compared with $153.18 million at the end of the prior quarter. Long-term debt amounted to $369.40 million, flat sequentially.

During the reported quarter, Insperity repurchased almost 308,000 shares for $56.8 million and paid out $19.9 million in cash dividends. Capital expenditures totaled $4.3 million.

Q3 Guidance

Adjusted EBITDA is anticipated between $59 million and $71 million. Average WSEEs are expected in the range of 301,300-303,900.

2022 Guidance

Insperity now projects adjusted earnings in the band of $4.68-$5.25 per share compared with the prior guidance of $4.31-$5.09. The current Zacks Consensus Estimate is pegged at $4.71, below the midpoint of the guided range ($4.965).

Adjusted EBITDA is now anticipated in the range of $305-$335 million compared with the prior guidance of $285-$327 million. Average WSEEs are expected to be 294,600-297,200 compared with the prior guidance of 289,600-294,700.

Currently, Insperity carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Performances of Some Other Business Services Companies

Equifax EFX reported mixed second-quarter 2022 results, wherein earnings beat estimates but revenues missed the same.

EFX’s adjusted earnings of $2.09 per share beat the Zacks Consensus Estimate by 3% and improved 5.6% on a year-over-year basis. Revenues of $1.32 billion missed the consensus estimate marginally but improved 6.6% year over year.

IQVIA Holdings IQV reported solid second-quarter 2022 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

IQV’s adjusted earnings per share of $2.44 beat the consensus mark by 2.1% and improved 15% on a year-over-year basis. Total revenues of $3.54 billion outpaced the consensus estimate by 1.2% and increased 3% year over year.

Omnicom Group OMC reported impressive second-quarter 2022 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

OMC’s earnings of $1.68 per share beat the consensus mark by 7.7% and increased 15.1% year over year, driven by a strong margin performance. Total revenues of $3.6 billion surpassed the consensus estimate by 4.4% but declined slightly year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance